Buying your first home feels overwhelming with so many moving parts to manage. The median first-time buyer spends 10 weeks searching for the right property, according to the National Association of Realtors.

We at Home Owners Association compiled these tips for buying your first home to simplify the process. This guide covers everything from financial preparation to closing day.

How Much Can You Actually Afford?

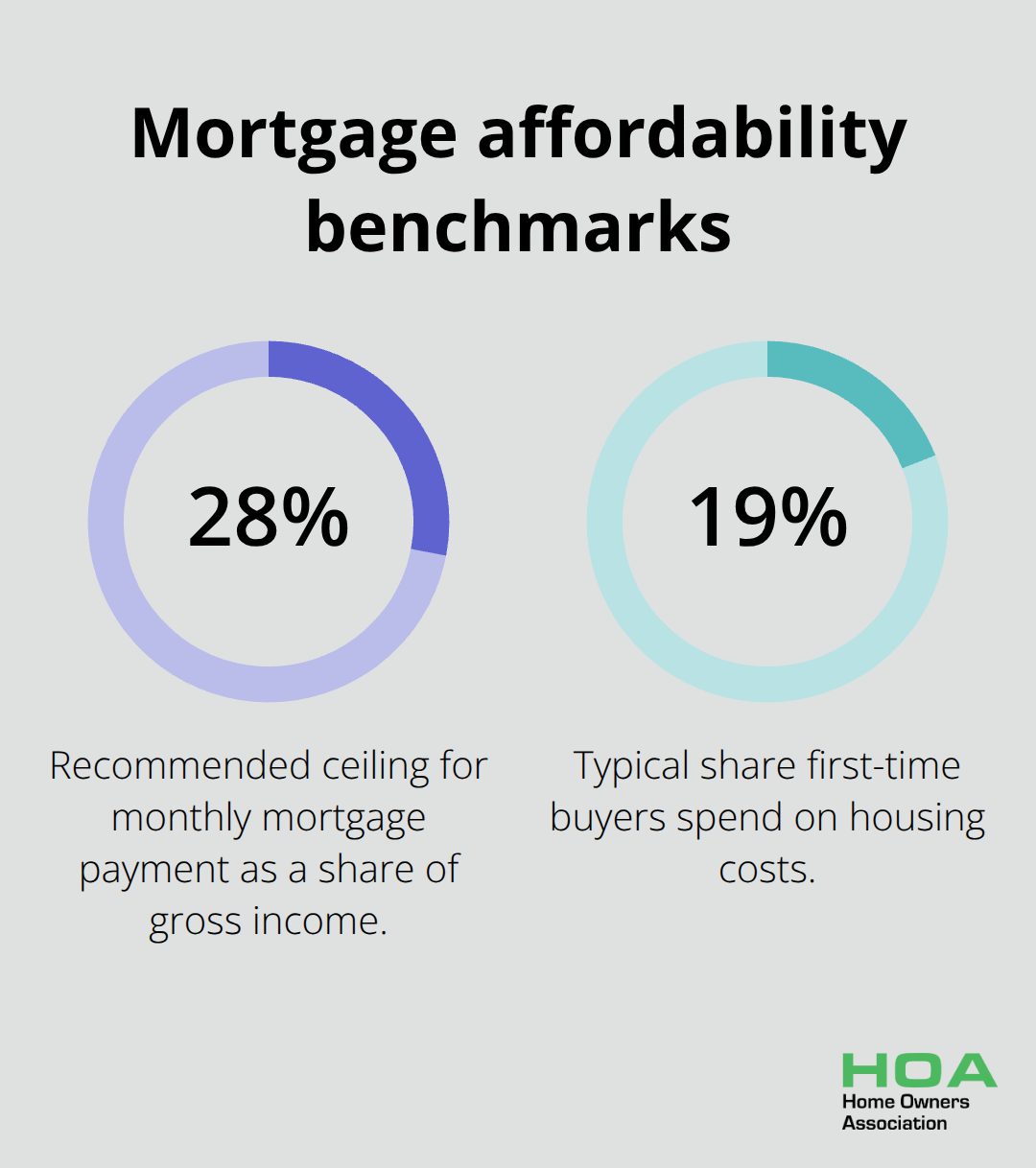

Your monthly mortgage payment should never exceed 28% of your gross monthly income, according to mortgage industry standards. The National Association of Realtors found that first-time buyers typically spend 19% of their income on housing costs, but this conservative approach often limits options in competitive markets. We recommend you push closer to the 28% threshold to access better neighbourhoods and properties that appreciate faster.

Calculate Your True Buying Power

Start with the debt-to-income ratio calculation that lenders use. Add all monthly debt payments (credit cards, student loans, and car payments), then divide by gross monthly income. Lenders prefer this ratio below 36%, with housing costs included. A borrower who earns $5,000 monthly with $500 in existing debt can afford roughly $1,300 in housing costs. Factor in property taxes, insurance, and HOA fees when you calculate affordability, as these add 20-30% to your base mortgage payment.

Build Credit and Save Strategically

Credit scores above 740 unlock the best mortgage rates and potentially save $50,000 over a 30-year loan compared to scores below 620. Pay down credit card balances to below 10% of limits and avoid new accounts six months before you apply. For down payments, try for 20% to avoid private mortgage insurance, which costs 0.5-1% annually. First-time buyers who use FHA loans need only 3.5% down but pay mortgage insurance for the loan’s life. Save in high-yield accounts that earn 4-5% rather than traditional accounts that pay 0.1%.

Get Pre-Approved Early

Mortgage pre-approval expires after 60-90 days, so time this process carefully. Pre-approved buyers win 85% more offers than those without approval, according to Zillow data. Shop with at least three lenders since rates vary by 0.25-0.5% between institutions. Lock rates when you find a property, as even small increases cost thousands over the loan term.

Once you establish your budget and secure pre-approval, the next step involves research and property evaluation to find homes that match both your financial capacity and lifestyle needs.

Where Should You Buy Your Home?

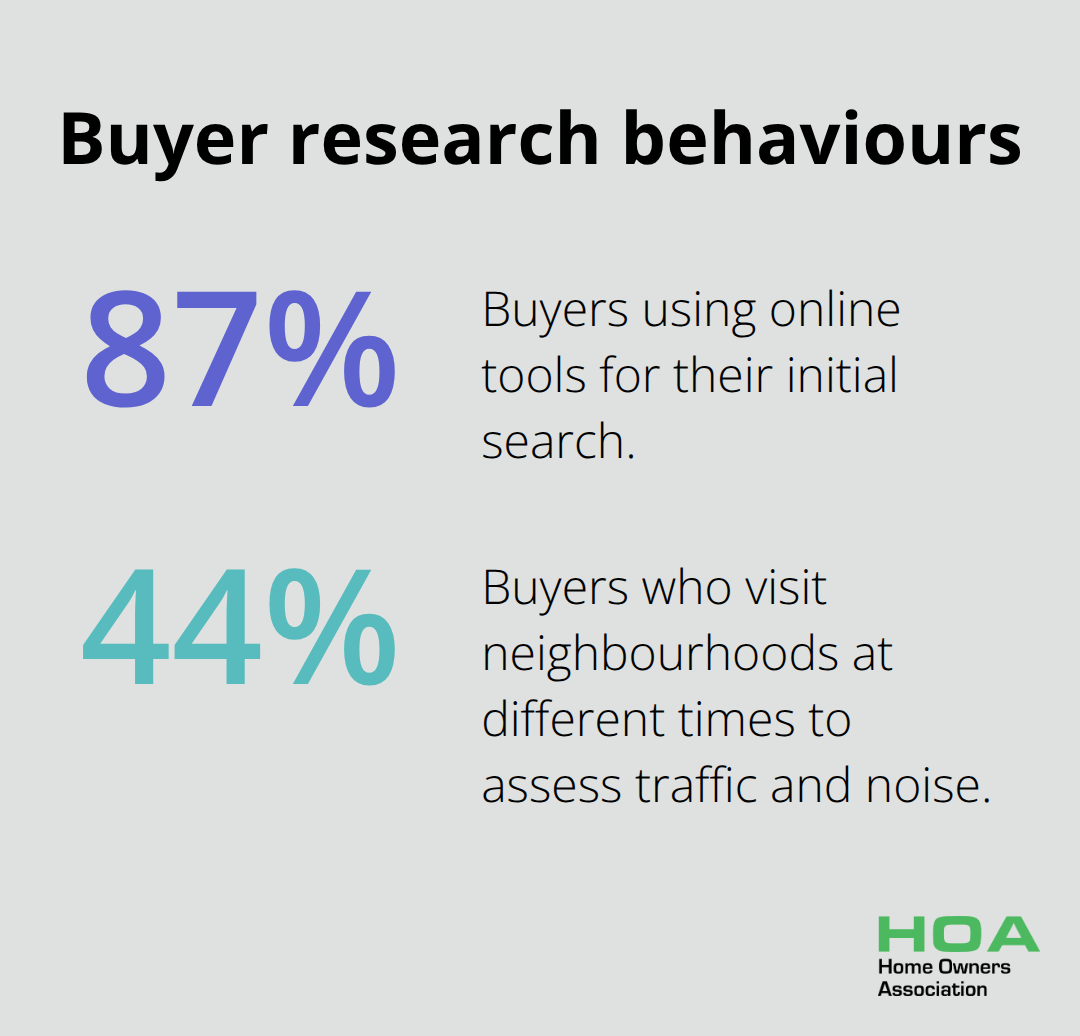

Property research separates successful buyers from those who overpay or choose poorly. The National Association of Realtors reports that 87% of buyers use online tools for their initial search, but only 44% visit neighbourhoods at different times to assess traffic patterns and noise levels. You should spend at least three weekends in your target area at various hours to understand the true character of each neighbourhood.

Research Market Conditions Like a Pro

Zillow data provides comprehensive home value insights and market changes across regions. Check local permits, school ratings, and planned infrastructure projects that drive future values. Areas with new transit lines or major employer relocations typically see 15-20% price increases within two years. Examine comparable sales from the past six months, not older data that reflects different market conditions.

Properties near schools in highly-rated districts sell for more and faster than those in lower-rated areas. Use tools like Redfin and Realtor.com to track price per square foot trends and days on market in specific ZIP codes. Markets where homes sell within 30 days indicate strong demand and potential wars between buyers. Understanding factors affecting house prices helps you make informed decisions about location and timing.

Work Smart with Real Estate Agents

Top agents close 40% more deals than average performers and know which properties will receive multiple offers before they hit the market. Interview three agents who specialise in your target neighbourhoods and have closed at least 20 transactions in the past year. Agents with strong local connections often hear about off-market properties that avoid wars between buyers entirely.

Complete Thorough Property Inspections

Hire professionals who charge $400-600 for comprehensive reports rather than bargain inspectors who miss costly issues. Structural problems, electrical systems, and HVAC repairs average $8,000-15,000 each (making thorough inspections worthwhile investments). Professional inspectors catch foundation cracks, outdated wiring, and failing systems that cost thousands to repair after purchase. Consider annual home maintenance costs when budgeting for your purchase.

Win with Strategic Offers

In competitive markets, offers that win exceed asking prices by 5-10% and include escalation clauses that automatically increase bids up to predetermined limits. Cash offers win 95% of the time against financed buyers, but financed offers with large earnest money deposits and quick timelines can compete effectively. Waive inspection contingencies only when you complete inspections before you make offers-a strategy that costs $500 upfront but demonstrates serious intent to sellers.

Once you identify the right property and submit a successful offer, the final phase involves inspections, appraisals, and mortgage approval to complete your purchase.

How Do You Complete Your Purchase?

Your accepted offer triggers a 30-45 day sprint to closing that demands precise coordination between multiple professionals. Home appraisals ordered by lenders take 7-10 business days and must match or exceed your purchase price, or you face renegotiation or loan denial. The Federal Housing Finance Agency reports that appraisal disparities can drive pricing challenges, which forces buyers to cover gaps with cash or walk away.

Professional inspections within your contingency period typically last 3-4 hours and cost $400-600, but they identify issues requiring attention. Homeowners spend an average of 7 hours weekly on home repairs and preventative maintenance. Schedule inspections immediately after contract acceptance since most contingency periods last only 7-10 days.

Secure Your Mortgage Rate and Insurance

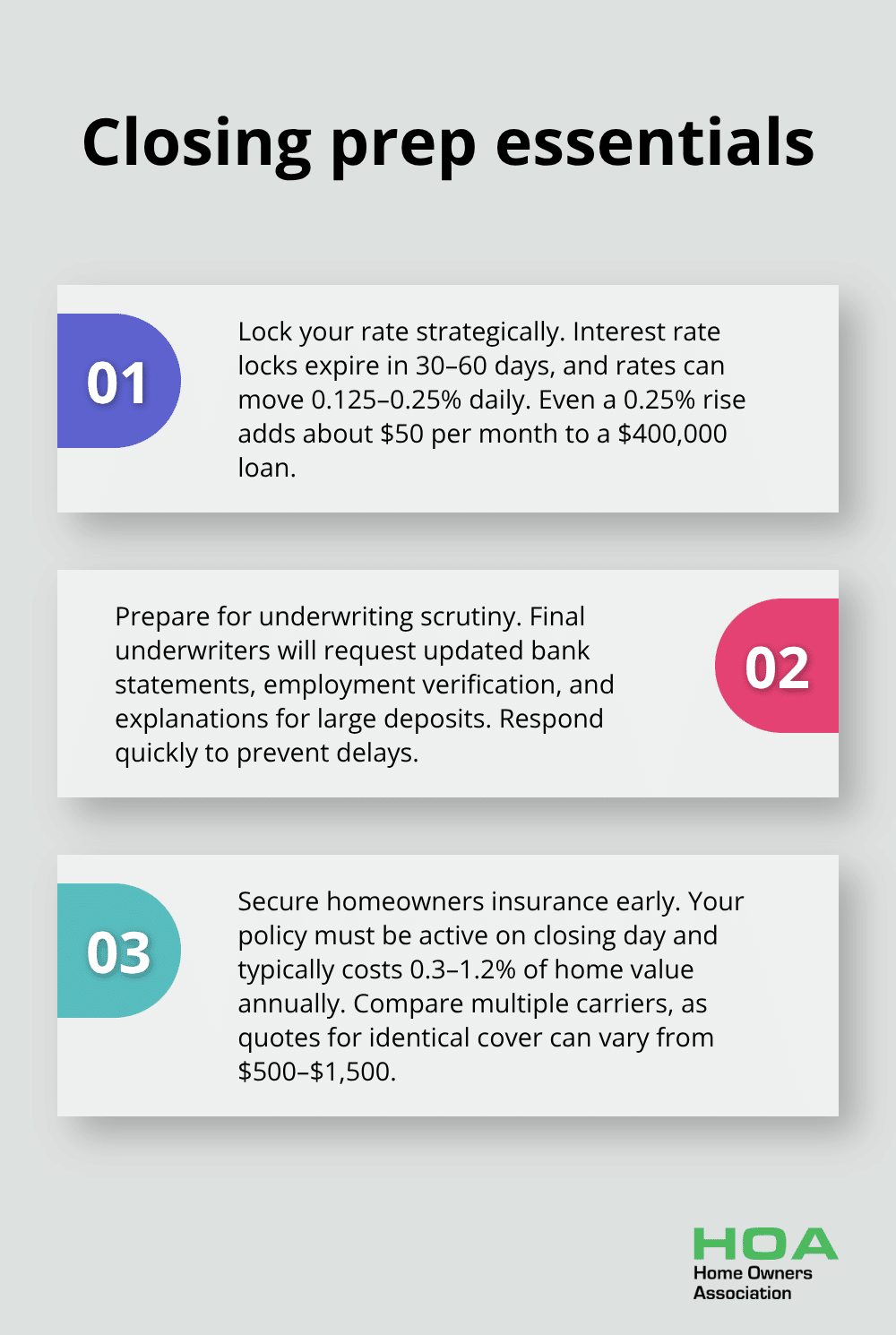

Interest rate locks expire in 30-60 days, and rates can shift 0.125-0.25% daily during volatile periods. Each 0.25% increase costs roughly $50 monthly on a $400,000 loan (which makes rate protection essential). Final underwriters require updated bank statements, employment verification, and explanations for any large deposits.

Avoid major purchases or credit applications during this period since lenders pull credit reports again before you close. Homeowners insurance must be active on your closing day and costs 0.3-1.2% of home value annually. Shop multiple carriers since quotes vary from $500-1,500 for identical coverage.

Navigate the Final Walkthrough

Final walkthroughs occur 24-48 hours before you close and serve as your last chance to verify repairs and property condition. Bring a checklist that covers all inspection items and test major systems including HVAC, plumbing, and electrical components. Document any issues immediately since sellers must address problems before you transfer ownership.

Complete the Closing Process

Closing costs range from 2-5% of purchase price and include title insurance, attorney fees, and prepaid taxes. Wire transfer fraud targets home buyers, so verify instructions through direct phone calls to your title company rather than trust email instructions. Review the Closing Disclosure three days before you sign since this document details all final costs and loan terms.

Title companies coordinate document signatures, fund transfers, and key exchanges on your closing day. Bring a certified cheque for your down payment and closing costs (personal cheques won’t work for large amounts). The entire process takes 1-2 hours, after which you receive keys to your new home.

Final Thoughts

These tips for buying your first home provide a roadmap through the complex purchase process. Smart buyers who follow the 28% income rule, maintain credit scores above 740, and complete thorough inspections position themselves for success. The biggest mistakes include skipping pre-approval, rushing neighbourhood research, and making major purchases during underwriting.

First-time buyers who overspend on their initial purchase often struggle with ongoing maintenance costs that average $8,000-15,000 annually. Avoid emotional decisions during negotiations and stick to your predetermined budget limits. Properties that seem perfect but stretch your finances create stress rather than satisfaction.

After closing, focus on building an emergency fund for unexpected repairs and maintenance. We at Home Owners Association recommend that you set aside 1-2% of your home’s value annually for upkeep. Melbourne homeowners can access trade pricing and expert guidance through our association (which has supported local property owners with substantial savings on materials and personalised project advice).