Buying your first home feels overwhelming, but the right preparation makes all the difference. We at Home Owners Association have guided thousands through this process successfully.

These home buying tips for first-time buyers will walk you through every step. From financial planning to closing day, you’ll gain the confidence needed to make smart decisions.

What Financial Steps Must You Take Before House Hunting

Your financial foundation determines everything in home purchase decisions. Start with your credit score because it directly impacts your mortgage rate and borrowing power. A score of 760 or higher may get the best rate, while scores below 620 face significantly higher costs. Check your credit report for errors and pay down existing debts to boost your score before you apply for pre-approval.

Calculate Your True Purchase Power

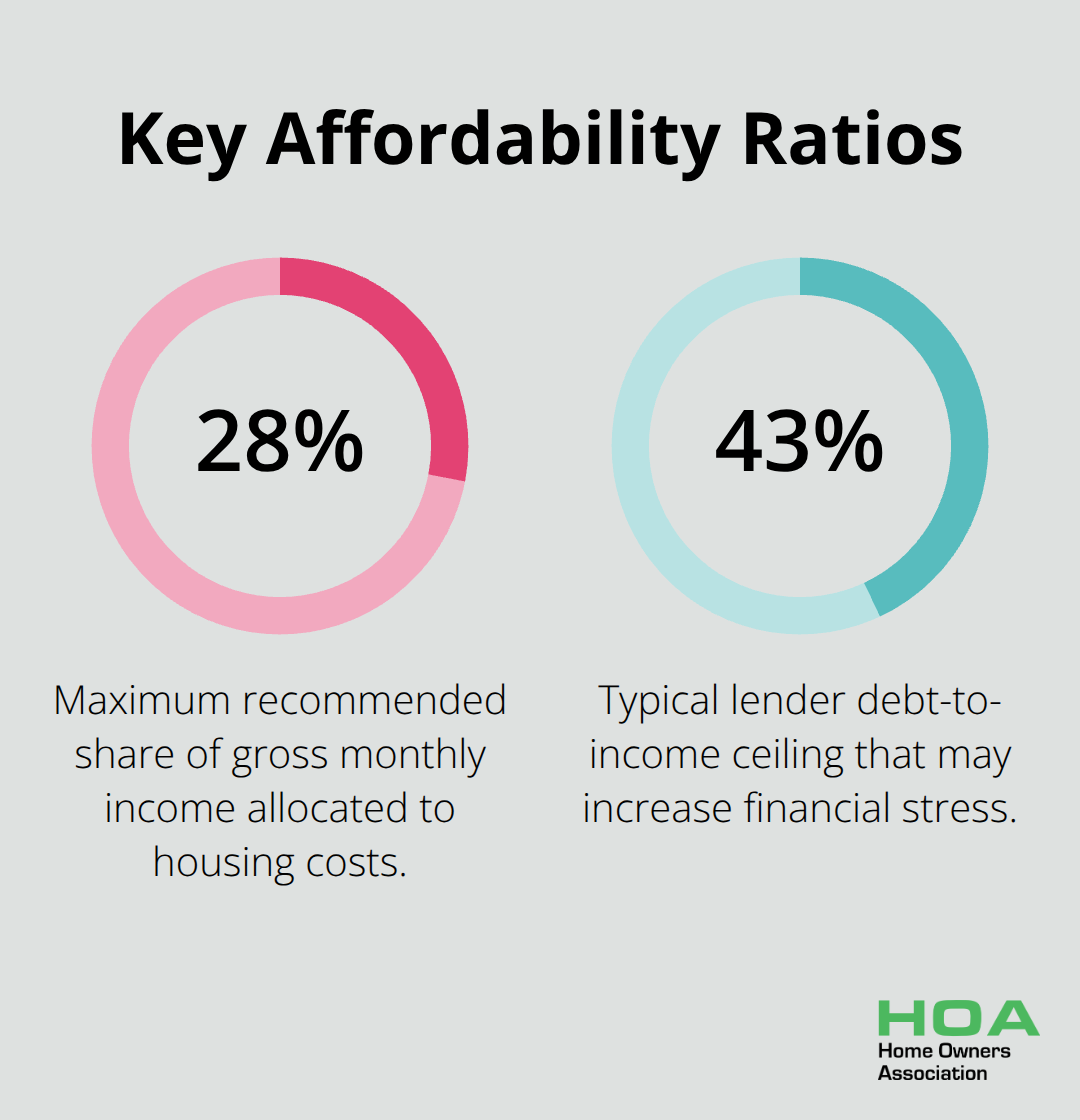

The 28% rule remains the gold standard for housing affordability. Your monthly mortgage payment should never exceed 28% of your gross monthly income. For a $5,000 monthly income, that means $1,400 maximum for principal, interest, taxes, and insurance combined. However, lenders now approve up to 43% debt-to-income ratios, which creates dangerous financial stress.

This higher ratio leaves no room for unexpected expenses or income changes. Factor in your existing debts, future maintenance costs, and emergency fund needs when you determine your budget.

Build Your Down Payment Strategy

Save at least 20% for your down payment to avoid private mortgage insurance (which adds $200-300 monthly on a $400,000 home). The 5% Deposit Scheme supports home buyers who have saved a minimum deposit of 5% of the property value and meet other eligibility criteria. Beyond the down payment, budget 2-5% of the home’s value for closing costs, inspections, and immediate move-in expenses. A $500,000 home requires $10,000-25,000 in additional costs beyond your down payment.

Secure Pre-Approval Documentation

Pre-approval gives you serious buyer status and clarifies your exact budget limits. Gather two years of tax returns, recent pay stubs, bank statements, and documentation of any additional income sources. Lenders verify every financial detail, so organise these documents early to speed up the process. Pre-approval typically lasts 60-90 days, which gives you a realistic timeline for your house hunt.

With your finances organised and pre-approval secured, you can now focus on the exciting part: finding neighbourhoods and properties that match both your budget and lifestyle needs.

Where Should You Focus Your Property Search

Your property search starts with data-driven neighbourhood analysis, not gut feelings. Use Zillow and Realtor.com to track price trends over the past 12 months in your target areas. Properties in neighbourhoods with consistent appreciation patterns offer better long-term value than areas with volatile price swings. The National Association of Realtors provides comprehensive real estate research and statistics, which makes digital tools your first step. Focus on neighbourhoods where median home prices align with your pre-approved budget and leave room for competitive offers that can push final prices 5-10% above the list price.

Choose Your Real Estate Professional Strategically

The right agent determines your success more than any other factor. Interview at least three agents who specialise in your target neighbourhoods and have closed 15+ transactions in the past year. Ask for references from recent first-time buyers and verify their local market knowledge by requesting recent comparable sales data. Attend open houses independently first to understand what you want, then bring your agent to serious contenders. This approach prevents agent influence during your initial property evaluation and helps you articulate your needs clearly.

Conduct Thorough Property Evaluations

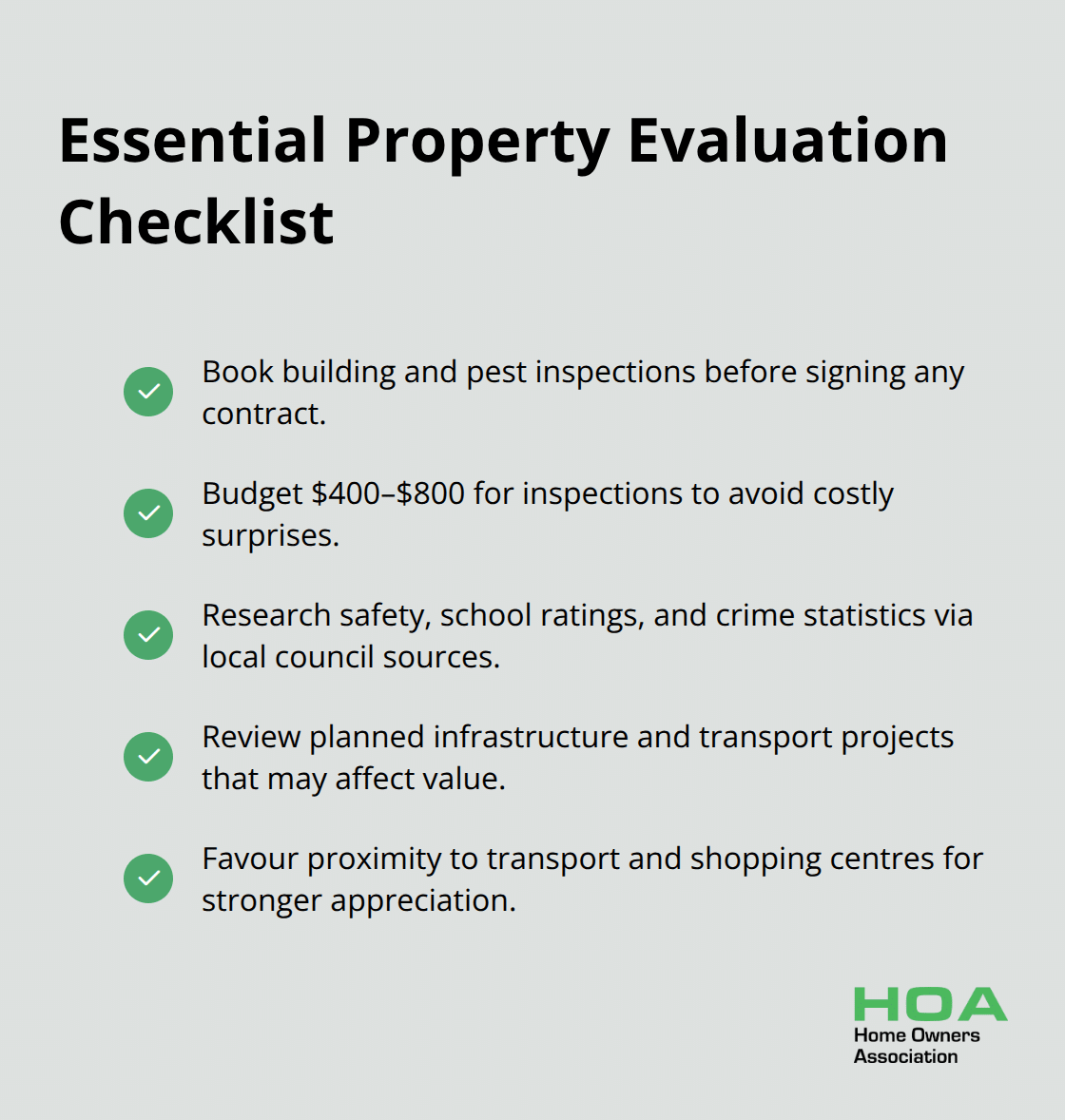

Schedule building and pest inspections before you sign any contract, not after. These inspections cost $400-800 but can save thousands when they identify structural issues, electrical problems, or pest damage. According to Experian, over 30% of buyers prioritise safety and low crime rates when they select neighbourhoods (which makes location research equally important as property condition).

Research local infrastructure developments, school ratings, and crime statistics through local council websites. Properties near planned transport improvements or shopping centres typically appreciate faster than isolated locations.

Evaluate Market Conditions and Timing

Market conditions directly impact your negotiation power and purchase timeline. In seller’s markets, properties receive multiple offers within days, while buyer’s markets allow more time for decisions and negotiations. Monitor inventory levels in your target areas through real estate websites and local market reports. Low inventory (under 3 months of supply) creates competitive conditions where you need pre-approval and quick decision-making skills. High inventory gives you leverage to negotiate price reductions and request seller concessions for repairs or closing costs.

Once you identify promising properties and understand local market dynamics, you’ll need to master the art of competitive offers and successful negotiations. For comprehensive guidance on the entire home buying process, consider reviewing essential first home buyer tips and financial preparation strategies.

How Do You Win the Purchase Process

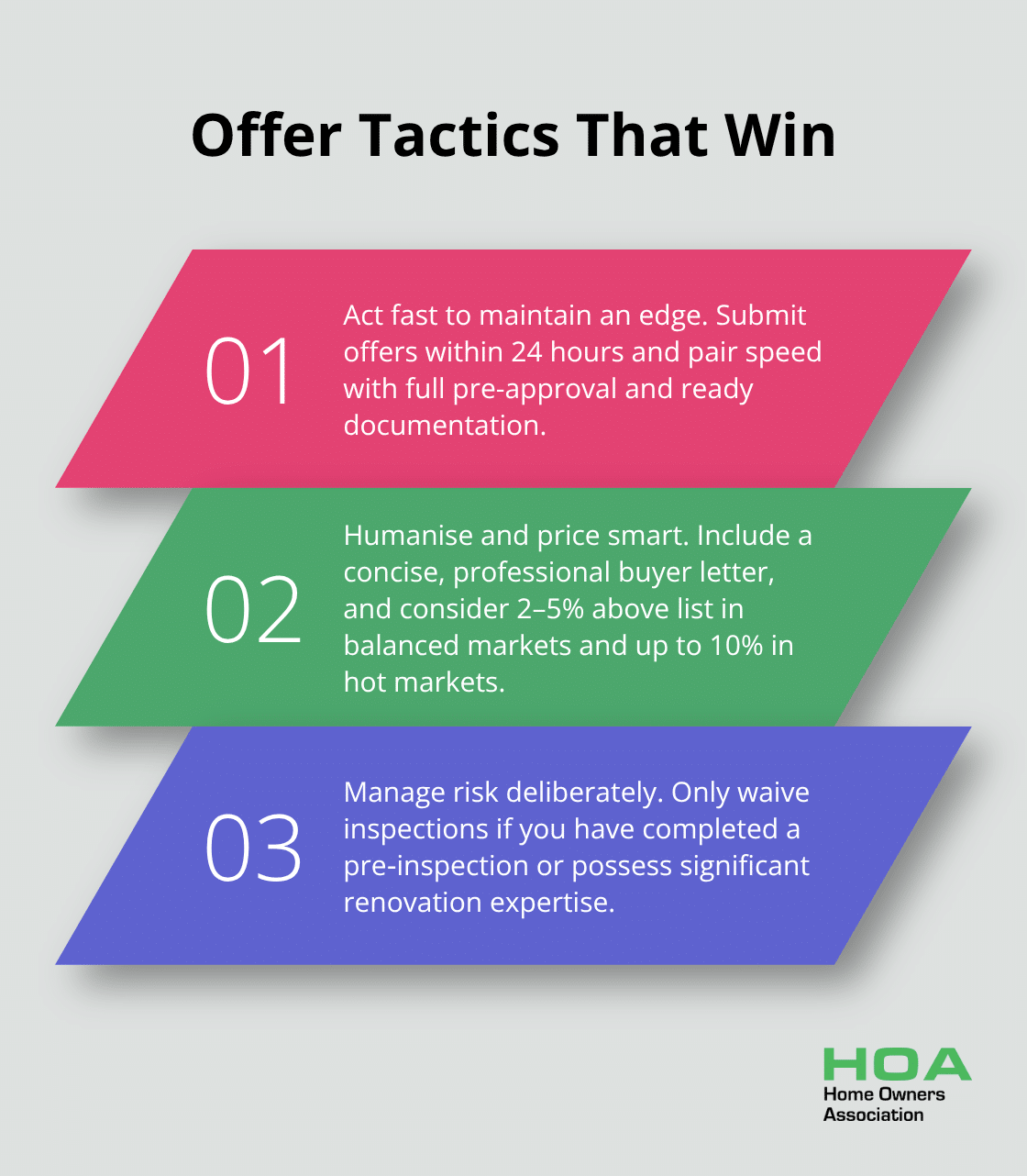

Your offer strategy determines success more than any other factor in competitive markets. Submit offers within 24 hours of property viewings because delays cost opportunities. Include a personal letter to sellers that explains why you want their home, but keep it brief and professional. Offer 2-5% above the list price in balanced markets and up to 10% above in hot markets where multiple offers are standard. Waive inspection contingencies only if you conducted a pre-inspection or have significant renovation experience.

Make Strategic Offers That Stand Out

Request seller concessions for closing costs when inventory exceeds certain levels, but avoid this strategy in competitive markets where sellers have multiple options. Escalation clauses automatically increase your offer by predetermined amounts (typically $1,000-$5,000 increments) up to your maximum price when competing offers emerge. Include proof of funds or pre-approval letters with every offer to demonstrate your financial capability to sellers.

Lock In Your Mortgage Terms

Convert your pre-approval to full approval immediately after offer acceptance. Submit all requested documentation within 48 hours to prevent delays that can jeopardise your closing timeline. Lock your interest rate for 45-60 days to protect against rate increases during the closing process. Fixed-rate mortgages provide payment stability, while adjustable rates start lower but create payment uncertainty after the initial period. Choose 30-year terms for lower monthly payments or 15-year terms to save significantly on total interest costs.

Navigate Settlement Documentation

Hire a qualified conveyancer immediately after offer acceptance because legal documentation requires proper preparation time. Review all contracts before you sign and request explanations for any clauses you don’t understand completely. Transfer funds for closing costs and down payment 2-3 business days before settlement to avoid wire transfer delays. Obtain home owners insurance quotes and bind coverage before the closing day because lenders require proof of insurance. Settlement typically takes 30 to 90 days depending on the agreement between buyer and seller.

Complete Your Final Property Checks

Schedule your final walkthrough 24-48 hours before closing to verify property condition and completed repairs. Conduct a final property inspection on closing day morning to verify no new damage occurred and all agreed repairs were completed properly. Check that all fixtures, appliances, and systems function as expected during this final inspection.

Final Thoughts

Your first home purchase becomes manageable when you follow these proven steps systematically. Start with solid financial preparation by checking your credit score, calculating your true affordability with the 28% rule, and saving at least 20% for your down payment. Focus your property search on data-driven neighbourhood analysis and work with experienced agents who specialise in your target areas.

Professional guidance makes the difference between costly mistakes and successful outcomes. Real estate agents, mortgage brokers, conveyancers, and building inspectors each bring specialised expertise that protects your interests throughout the transaction. These home buying tips for first time buyers work best when you combine them with expert support at every stage (which reduces stress and prevents expensive errors).

We at Home Owners Association have supported Melbourne home owners with exclusive member benefits, trade pricing discounts, and expert guidance for construction and renovation projects. Your first home purchase marks the start of your home ownership journey. The right preparation builds confidence for this significant financial decision.