Buying your first home feels overwhelming with countless decisions and financial complexities. The median home price hit $436,800 in 2024, making preparation more important than ever.

We at Home Owners Association compiled these essential tips for 1st time home buyers based on current market data. These strategies will help you navigate today’s competitive housing market successfully.

Essential Financial Preparation for Home Buying

Financial preparation separates successful buyers from those who face foreclosure later. The Federal Housing Administration requires a minimum credit score of 620, but we recommend you target 720 or higher to access the best interest rates. A single point increase in your credit score can save you $25,000 over a 30-year mortgage on a $400,000 home. Start by paying down existing debt and avoid opening new credit accounts during your home search period.

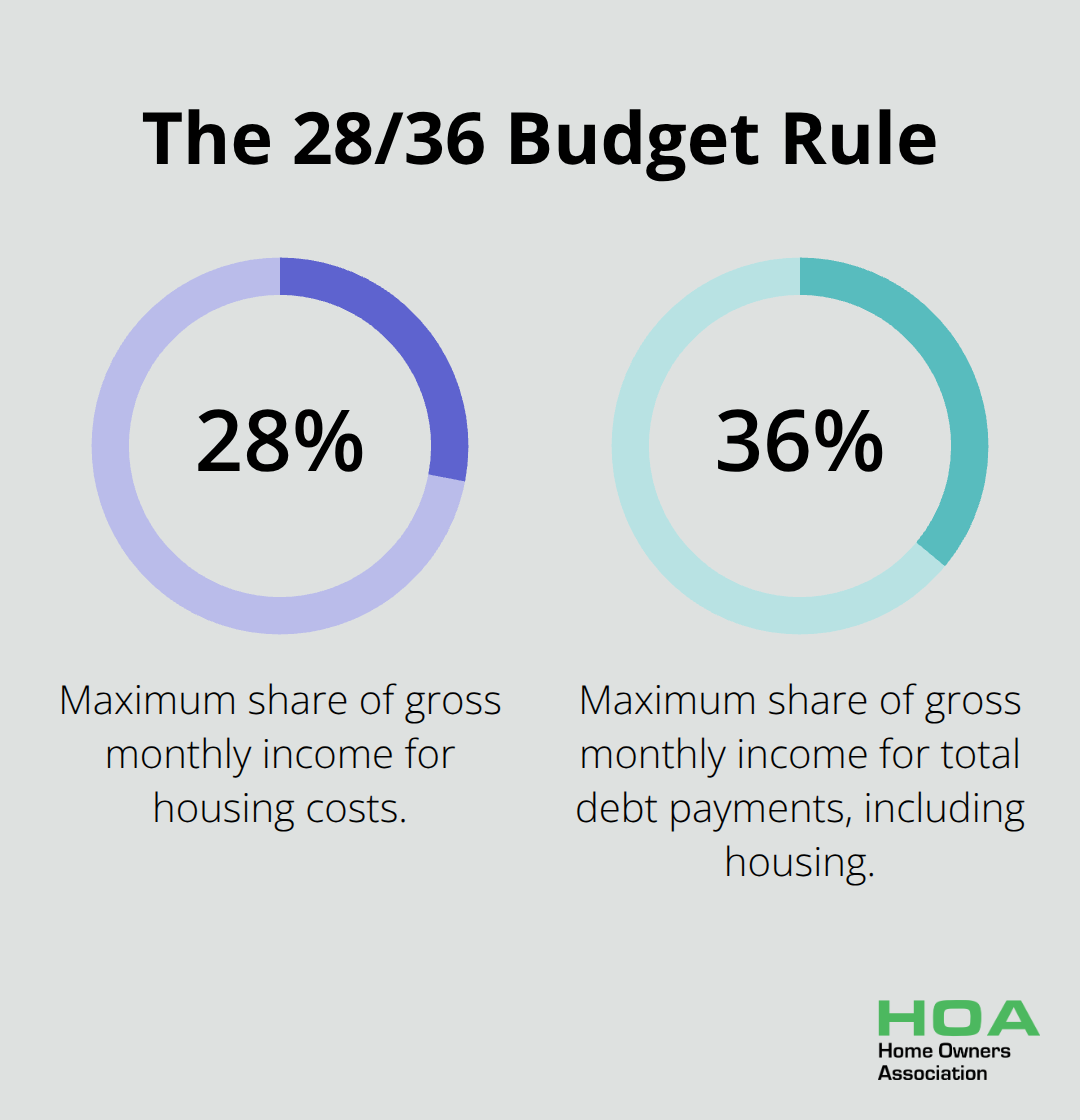

Calculate Your Real Housing Budget

The 28/36 rule provides a solid foundation: spend no more than 28% of gross monthly income on housing costs and 36% on total debt payments. However, this rule fails in today’s market where property taxes and insurance costs have surged. Factor in maintenance costs at 1-2% of home value annually, plus utilities that average $150-$300 monthly. A $400,000 home requires approximately $4,000-$8,000 yearly for upkeep alone.

Build Your Down Payment Strategy

Save 20% down payment to avoid private mortgage insurance, which costs 0.5-1% of loan amount annually. On a $400,000 home, PMI adds $166-$333 monthly. Recent research shows that 82% of buyers have regrets about their purchase decisions. Consider FHA loans that require just 3.5% down, or VA loans with zero down payment for eligible veterans. These programs help you enter the market faster while you build equity.

Secure Pre-Approval Before House Hunting

Pre-approval gives you negotiating power and speeds up closing by 15-20 days compared to pre-qualification letters. Lenders verify income, assets, and credit during this process, which reveals your true buying power. Rate locks typically last 60-90 days and protect you from interest rate increases while you shop. Compare offers from at least three lenders since rates can vary by 0.25-0.5% between institutions (potentially saving thousands over your loan term).

With your finances in order and pre-approval secured, you can focus on finding the perfect property that matches both your budget and long-term goals.

Finding and Evaluating the Right Property

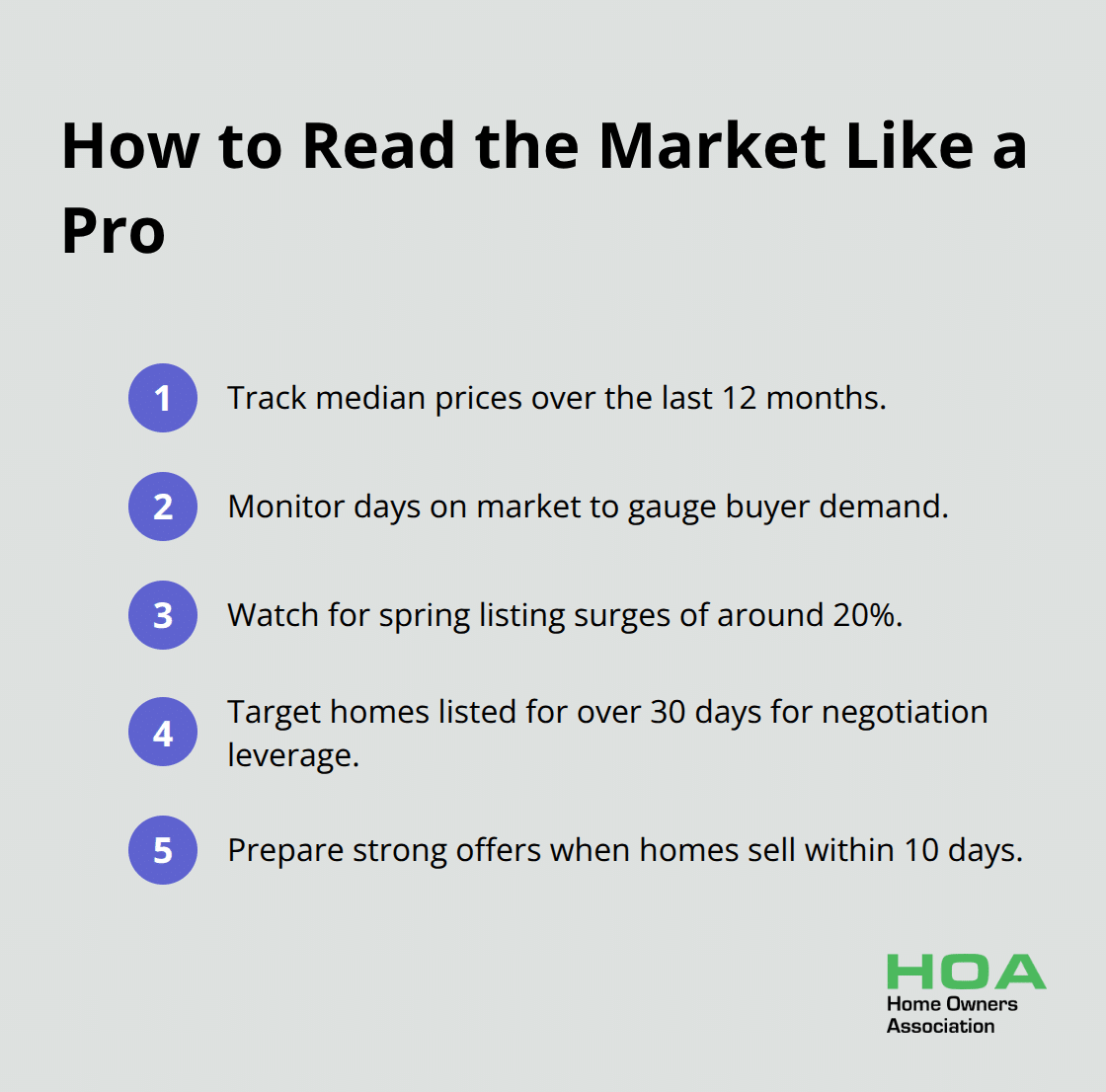

Property selection requires data-driven decisions rather than emotional reactions. CoreLogic reports national home values rose nearly 2% between January and May 2025, with spring bringing a 20% seasonal increase in listings. This timing creates opportunities but demands strategic thinking. Research neighbourhoods using Zillow or Redfin to track median prices, days on market, and price trends over 12 months.

Properties that sit longer than 30 days signal negotiation opportunities, while homes that sell within 10 days indicate hot markets where you need competitive offers.

Target Neighbourhoods with Growth Potential

Melbourne leads first-home buyer activity with nearly half of Australia’s first-home buyer hotspots, while Sydney buyers focus on western suburbs like Mount Druitt and Liverpool for affordability. The Real Estate Institute of Australia shows 65% of professionals predict house prices will rise in 2025, which makes location selection critical. Study infrastructure developments, school ratings, and crime statistics through local council websites. Properties near planned transport links or shopping centres show strong growth potential based on expert predictions for short- to medium-term price appreciation. Perth, Adelaide, and Brisbane show strongest capital growth potential due to migration patterns and constrained housing supply.

Inspect Properties Like a Professional

Schedule building and pest inspections before you make offers since 20% of buyers skip this step and face costly surprises later. Professional inspections cost $400-800 but can reveal $10,000+ in hidden repairs. Check for water damage around windows, uneven floors that indicate foundation issues, and outdated electrical systems that require immediate upgrades. Test water pressure, examine roof conditions, and verify HVAC functionality. Properties with recent renovations need extra scrutiny since cosmetic improvements often hide structural problems. Document everything with photos and request repair estimates before you finalise offers.

Win Competitive Markets with Smart Tactics

Auction clearance rates remain strong for well-presented homes, which creates competitive environments where strategy matters more than highest offers. Submit offers with minimal contingencies and flexible closing dates to stand out from other buyers. Escalation clauses automatically increase your bid by predetermined amounts up to your maximum limit (giving you advantages in multiple-offer situations). Pre-approval letters from reputable lenders carry more weight than online pre-qualifications. Consider offering above asking price but request seller-paid closing costs to reduce upfront expenses while you appear competitive.

Once you identify the right property and win the bidding process, you must navigate the complex legal and administrative requirements that transform your offer into actual ownership.

Navigating the Home Buying Process

Contract terms determine your financial obligations and legal protections for the next 30 years, yet most buyers spend less than 30 minutes to review these documents. Cooling-off periods vary by state and give you time to withdraw from unfavourable agreements, though you may forfeit 0.25% of the purchase price as a penalty. Most buyers lose thousands because they accept standard contract terms without negotiation. Request seller-paid costs, extended inspection periods, and appraisal contingencies that protect you from overpayment. Include specific repair requirements rather than vague language like “satisfactory condition” since sellers interpret this differently than buyers expect.

Schedule Professional Inspections Within 7 Days

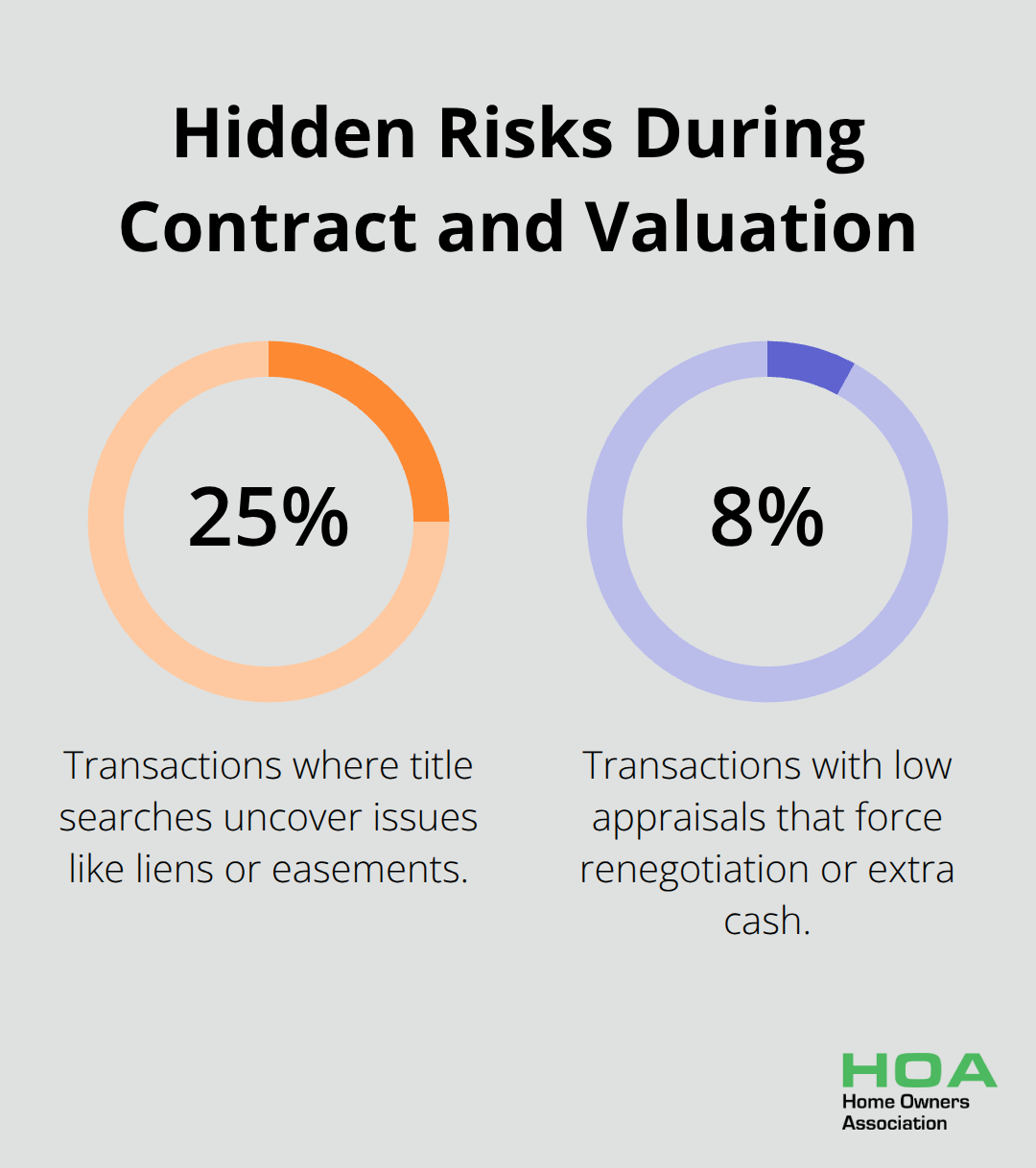

Coordinate structural, pest, and specialised inspections immediately after contract acceptance since most agreements allow 7-10 days maximum. Professional structural engineers cost $800-1,200 but identify foundation issues that average $15,000 to repair. Electrical inspections reveal outdated systems that insurance companies refuse to cover, while plumbing assessments catch problems that flood homes within months of purchase. Property inspections should not be overlooked when buying a home since a thorough inspection can uncover hidden issues that could cost you thousands in the future. Appraisals typically take 10-14 days to complete and must match or exceed your contract price for loan approval. Low appraisals occur in 8% of transactions according to recent industry data and force renegotiation or additional cash from buyers.

Understand Contract Terms and Conditions

Review every clause in your purchase agreement since standard forms favour sellers over buyers. Contingency clauses protect you from financial loss if inspections reveal major problems or if your mortgage application fails. Title searches uncover liens, easements, or ownership disputes that could block your purchase (these issues appear in 25% of transactions). Property disclosure statements require sellers to reveal known defects, but many states allow “as-is” sales that shift all risks to buyers.

Attorney review periods give you 3-5 days to modify contract terms after both parties sign the initial agreement.

Prepare $8,000-15,000 for Settlement Costs

Settlement costs range from 2-5% of purchase price and include title insurance, attorney fees, recording charges, and prepaid property taxes. Lenders must provide Closing Disclosure forms three days before settlement and show exact amounts for every fee. Wire fraud that targets home buyers has resulted in $145 million in real estate wire fraud losses, so verify wire instructions through phone calls to title companies rather than email confirmations. Settlement requires certified funds since personal cheques face 3-day periods that delay closings. Finalise your mortgage with a signed contract in hand and provide your lender with all necessary documentation promptly to avoid delays. Schedule final walkthroughs 24 hours before settlement to confirm that agreed repairs were completed and no new damage occurred since your last visit.

Final Thoughts

Successful home purchases demand disciplined financial preparation, thorough property research, and careful contract navigation. The most effective tips for 1st time home buyers focus on credit scores above 720, adequate down payments, and pre-approval before house hunting. These fundamentals separate successful buyers from those who face financial difficulties later.

Most buyers make costly mistakes that drain thousands from their budgets. Professional inspections prevent expensive surprises, contract negotiations protect your interests, and accurate cost estimates prevent budget overruns. The 57% of borrowers who wished they had researched more before their first home loan prove that preparation beats speed every time.

Property ownership extends beyond monthly payments to include maintenance, insurance, and renovations that enhance long-term value (emergency funds become essential for unexpected repairs). Focus on equity growth through strategic improvements while you build wealth over time. We at Home Owners Association provide expert guidance and educational resources that help members make confident property decisions throughout their homeownership journey.