Buying your first home feels overwhelming with mortgage rates, inspections, and endless paperwork. We at Home Owners Association see new buyers make the same costly mistakes repeatedly.

The right 1st time home buying tips can save you thousands of dollars and months of stress. This guide breaks down the essential steps that successful first-time buyers follow to secure their dream home.

How Much Money Do You Actually Need?

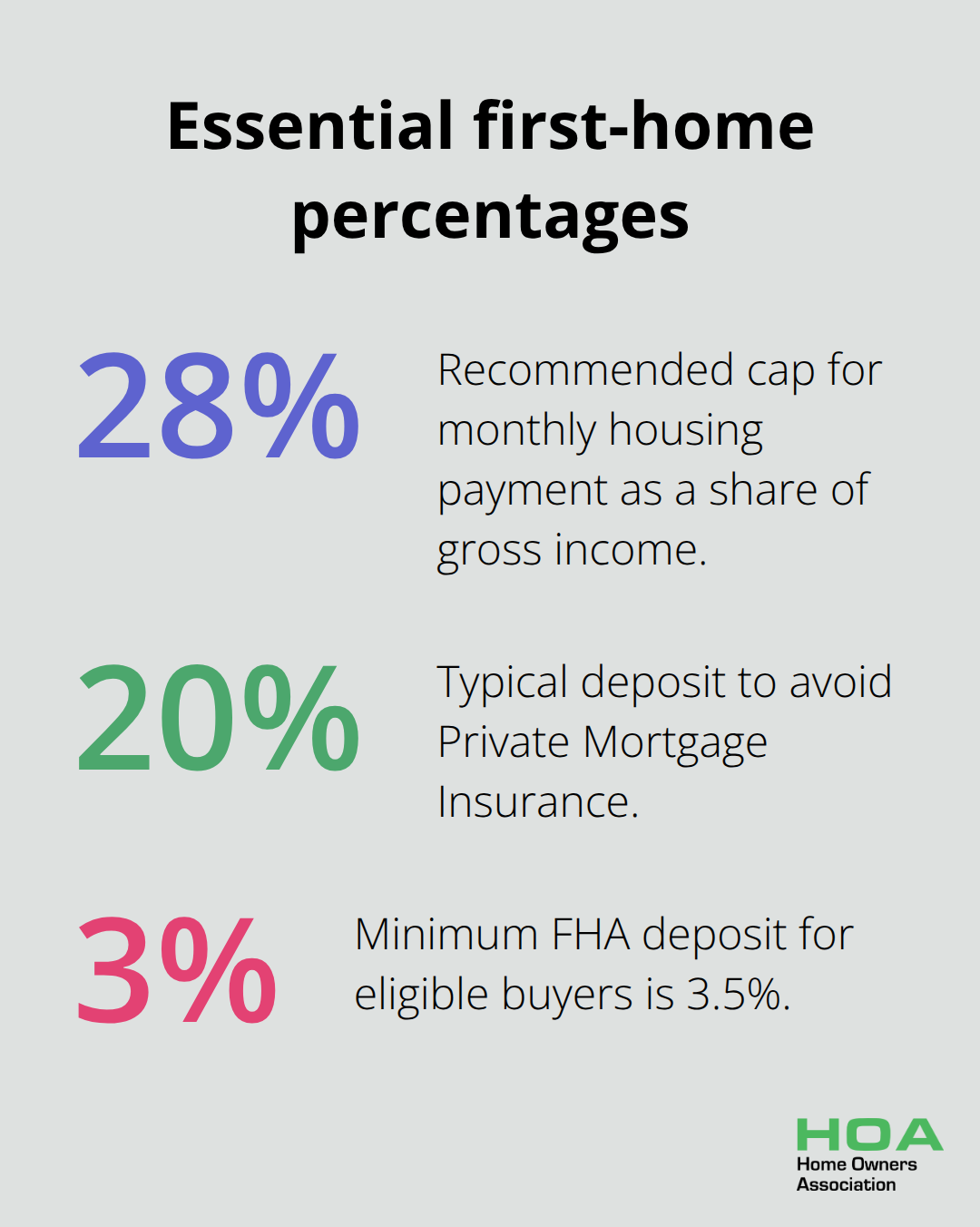

Financial readiness determines whether you become a homeowner or spend months in fruitless searches. The National Association of Realtors reports that first-time homebuyers now represent 34% of all purchases, with an average age of 33 years. Most buyers need 20% down to avoid Private Mortgage Insurance, but government programs like the Federal Housing Administration loans accept as little as 3.5% down for buyers with lower credit scores who qualify.

Calculate Your True Budget Beyond the Purchase Price

Your monthly payment should never exceed 28% of your gross income, but closing costs add another 2% to 5% of the home price. The Consumer Financial Protection Bureau found that first-time buyers face complex regulatory requirements during the closing process. Property taxes vary dramatically by location and can increase your monthly payment by hundreds of dollars. Home inspections cost $300 to $500 but prevent expensive surprises later. Add 1% of the home value annually for maintenance costs that most buyers forget to budget.

Build Your Credit Score to 740 or Higher

Credit scores directly impact your mortgage rate and monthly payments. A score of 740 or higher qualifies you for the best rates, while scores below 620 limit your options to FHA loans. The FDIC’s analysis shows that loan pricing varies based on multiple factors including credit quality. Pay down credit card balances to below 10% of limits and avoid new accounts six months before you apply. Even a 0.5% interest rate difference saves substantial money over a 30-year loan term (potentially thousands of dollars annually).

Get Pre-approved Before House Hunting

Pre-approval gives you a clear limit and strengthens your position against other buyers. Zillow reports that homes listed in spring sell faster and at higher prices, which makes pre-approval essential in competitive markets. Compare rates from multiple lenders since mortgage terms vary widely. Skip pre-qualification letters that mean nothing to sellers. Real pre-approval requires income verification, credit checks, and asset documentation that takes several weeks to complete properly.

With your finances in order and pre-approval secured, you can focus on the next critical step: locating the perfect property in the right neighbourhood.

Where Should You Buy Your First Home?

Location determines your home’s future value more than any other factor. The Reserve Bank of Australia reports that national home values rose 1% in November 2025, marking the third straight month of gains above 1%. KPMG’s analysis shows only 12% of homes nationally remain within reach of first-time buyers, creating intense competition in affordable neighbourhoods.

Research Neighbourhoods Like a Professional Investor

Study school districts even if you don’t have children yet, as homes in top-rated zones appreciate faster and sell quicker. Check crime statistics, commute times to major employment centres, and planned infrastructure developments that affect property values. Walk neighbourhoods at different times and days to understand traffic patterns, noise levels, and community dynamics that online research cannot reveal.

Target Areas Before They Peak

Smart buyers focus on neighbourhoods that show early signs of growth rather than established expensive areas. Look for suburbs with new coffee shops, restaurants, and retail developments that signal rising demand. The Australian Bureau of Statistics shows residential dwelling numbers rose by 53,800 this quarter, with mean prices increasing by $23,000. Study council development plans for transport links, shopping centres, and zoning changes that create value.

Choose the Right Real Estate Agent

Professional real estate agents provide market insights but choose those who specialise in your target price range and area rather than generalists who lack deep local knowledge. Avoid agents who push you toward properties outside your budget or fail to explain market conditions clearly. The best agents understand local pricing trends and can identify properties with strong appreciation potential.

Complete Professional Inspections on Every Property

Schedule inspections for structural issues, electrical systems, plumbing, and pest problems before you make final offers. KPMG warns that poor construction quality poses significant risks to first-time buyers who choose cheaper properties. Attend inspections personally to ask questions and understand maintenance requirements (inspection costs of $300 to $500 prevent disasters that cost thousands later). Properties with asbestos, foundation problems, or major electrical issues require expensive remediation that destroys your budget.

Never waive inspection contingencies to make offers more competitive since repair costs often exceed your savings from a lower purchase price. Once you’ve identified the perfect property and completed thorough inspections, you’ll need to master the art of competitive offers and contract terms.

How Do You Win in Competitive Markets?

Competitive offers require strategic timing and financial preparation that separate successful buyers from those who lose multiple bidding wars. The Reserve Bank of Australia data shows investor borrowing increased faster than owner-occupier loans, with new loan commitments for dwellings rising 6.4% in the September quarter 2025. This creates intense competition where first-time buyers frequently face experienced investors with cash advantages. Auction activity increased 3.8% year-on-year according to REA Group’s PropTrack, contributing to a competitive environment where properties sell within days of listing.

Submit Offers Above Asking Price With Strong Terms

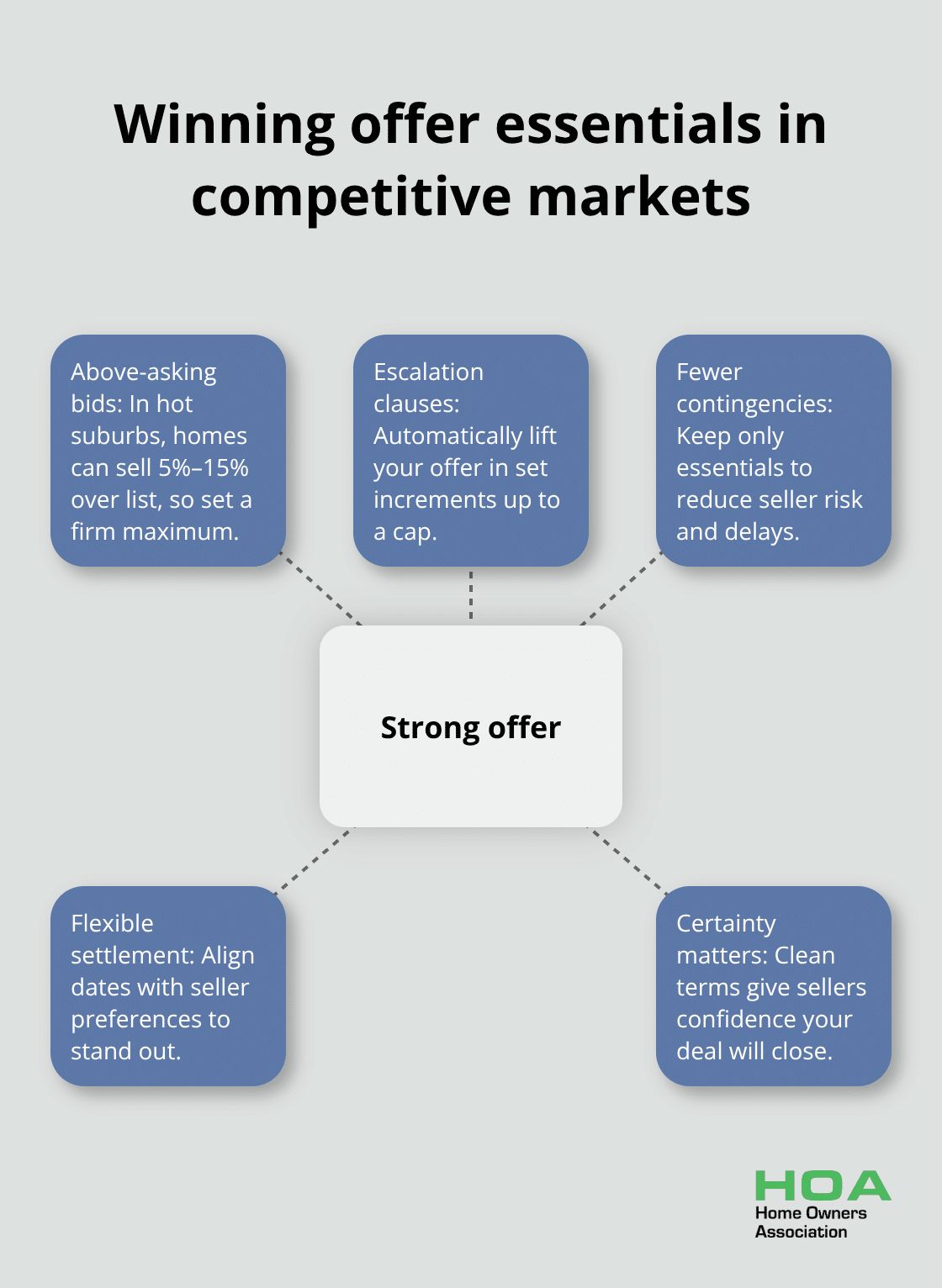

Properties in desirable areas routinely sell 5% to 15% above asking price, so prepare mentally and financially for bidding wars. Include escalation clauses that automatically increase your offer by specific amounts up to your maximum budget when competing bids emerge. Limit contingencies to essential items only since sellers favour clean offers with fewer conditions that could delay or complicate closing.

Offer flexible closing dates that accommodate seller preferences, and consider waiving financing contingencies only if you have guaranteed loan approval. Contract terms matter as much as price since sellers choose offers that provide certainty and minimise their risk of deals falling through.

Master Contingency Periods and Legal Protection

Standard purchase contracts include inspection, financing, and appraisal contingencies that protect buyers from major problems. Inspection contingencies typically allow 7 to 14 days to identify structural, electrical, or pest issues that require expensive repairs. Financing contingencies protect you if mortgage approval fails, while appraisal contingencies cover situations where the home values below your offer price. Never waive inspection rights completely since repair costs often exceed any savings from a more competitive offer.

Prepare for Closing Costs and Final Steps

Upfront costs include conveyancing fees, stamp duty, and inspection costs that add thousands to your final expenses. Schedule your final walkthrough 24 to 48 hours before closing to verify the property condition matches your expectations and all agreed repairs were completed properly. Bring certified funds for closing costs and down payment since personal cheques are not accepted at settlement.

Final Thoughts

First-time home buyers must calculate their true budget with closing costs and maintenance expenses, build credit scores above 740, and secure pre-approval before they start house searches. Professional inspections prevent expensive surprises while competitive offers with strong terms win properties in tight markets. These 1st time home buying tips help new buyers navigate markets where only 12% of homes remain affordable.

Professional guidance prevents costly mistakes throughout this complex process. Real estate agents provide market expertise, mortgage brokers compare loan options, and conveyancers handle legal requirements that protect your interests. The right professionals save money and reduce stress during your property purchase.

Homeownership builds wealth through property appreciation and equity growth over time. The Reserve Bank of Australia reports national home values rose 6.1% over the past year, which demonstrates real estate’s wealth potential (this trend continues despite market challenges). We at Home Owners Association support Melbourne homeowners with resources and expert advice that maximise property investment returns.