Buying your first home represents one of life’s biggest financial decisions. The process can feel overwhelming without proper preparation and guidance.

We at Home Owners Association have compiled essential first home buying tips to help you navigate this journey successfully. From financial preparation to closing day, these strategies will set you up for homeownership success.

What Financial Steps Must You Take Before House Hunting?

Start With a Complete Financial Assessment

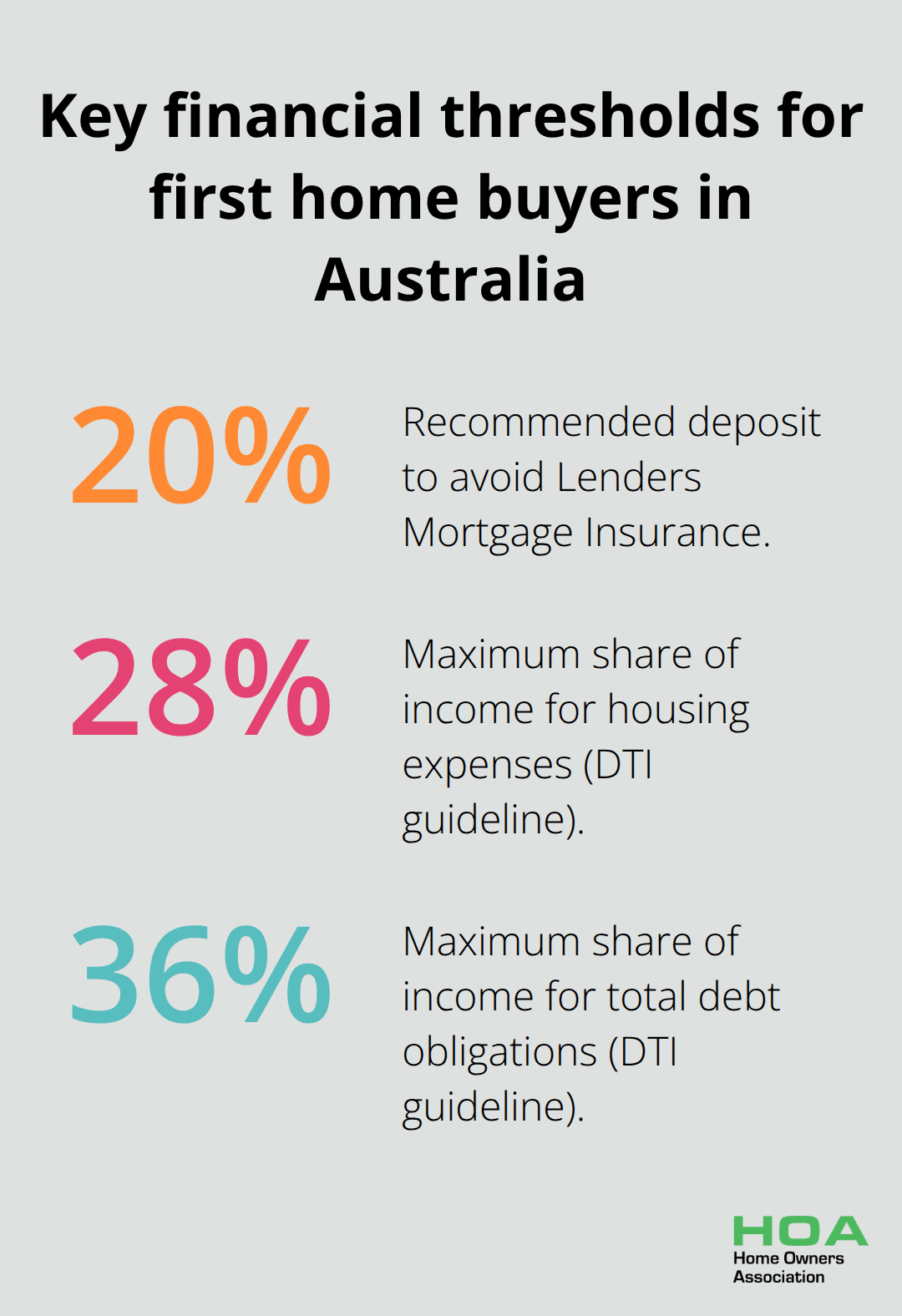

Your financial foundation determines everything about your home purchase. Calculate your monthly income, list all debts, and track expenses for three months to identify areas where you can redirect money toward homeownership goals. The average Australian first home buyer needs a deposit of 20% to avoid Lenders Mortgage Insurance (which typically costs between $10,000 to $50,000 annually). Your debt-to-income ratio should stay below 28% for housing expenses and 36% for total debt obligations. Banks scrutinise these numbers intensively, so accuracy matters more than optimism.

Build Your Deposit and Emergency Fund Strategically

The First Home Super Saver Scheme allows you to save up to $50,000 plus earnings through voluntary super contributions, with up to $15,000 annually. You benefit from lower tax rates that accelerate growth. Simultaneously, maintain an emergency fund that covers six months of expenses separate from your deposit. Property purchases involve unexpected costs including stamp duty, legal fees, building inspections, and moving expenses that can add $15,000 to $30,000 to your budget. The 5% Deposit Scheme provides government backing for eligible first home buyers, but you still need cash reserves for settlement day and immediate home expenses.

Transform Your Credit Profile Before You Apply

Your credit score directly impacts interest rates and loan approval odds. A difference of 0.5% in interest rates saves thousands over your loan term. Pay down credit card balances, avoid new credit applications for six months before house hunting, and dispute any errors on your credit report immediately. Lenders prefer borrowers with credit scores above 700, stable employment history that exceeds two years, and consistent savings patterns. Check your credit report quarterly and maintain credit utilisation below 30% of available limits (this shows responsible credit management).

Pre-approval for a home loan provides a clear budget and demonstrates to sellers that you’re a serious buyer. Once you establish solid financial foundations, you can confidently move forward to identify the right property and location for your needs.

Where Should You Look for the Right Property

Research Markets with Data-Driven Analysis

The average Australian home buyer views 15 properties before making an offer, but successful buyers research markets strategically rather than browse randomly. Start with suburb analysis through tools like CoreLogic and Domain to track median prices, growth rates, and days on market. Properties in school zones can add significant value to a home’s worth.

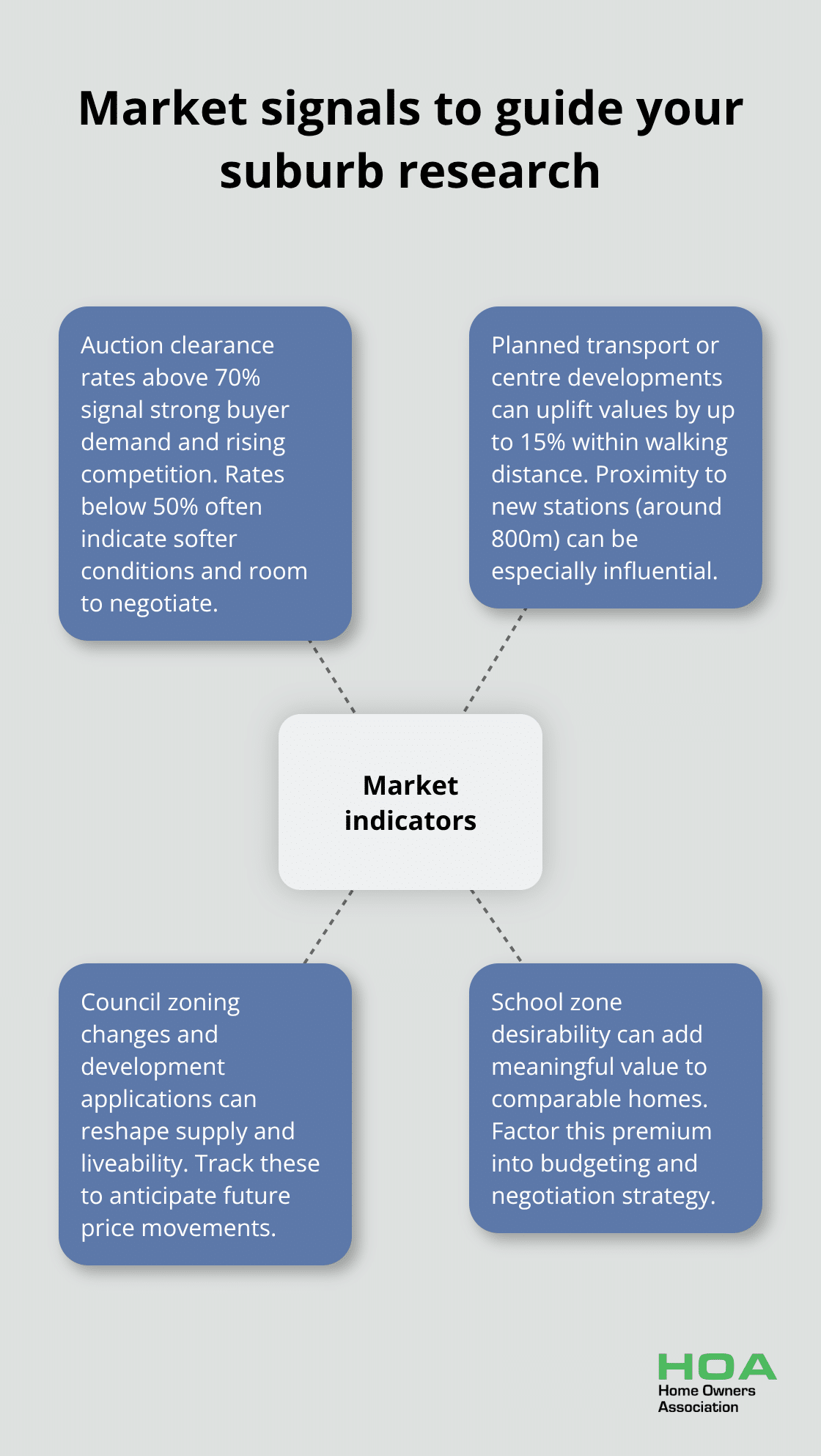

Focus on areas with planned infrastructure developments like new train stations or centres, which can increase property values by up to 15% for homes within 800m of new stations. Check council websites for upcoming zone changes and development applications that could impact your investment. Auction clearance rates above 70% indicate strong buyer demand, while rates below 50% suggest negotiation opportunities.

Target Properties Within Your Verified Budget Range

Real estate agents earn higher commissions on expensive properties, so they often push buyers beyond their means. Stick rigidly to your pre-approved loan amount minus 10% for unexpected costs. Properties listed 5-10% above comparable sales indicate motivated sellers who will likely accept lower offers.

Attend weekend open inspections in your target suburbs for six weeks before you make offers to understand local price patterns. Schedule inspections within 48 hours of conditional offers to avoid loss to cash buyers (this timeline protects your position while maintaining speed).

Evaluate Property Condition and Long-Term Costs

Properties with recent renovations often hide structural problems, while original condition homes reveal their true state. Single-storey homes typically require less maintenance than multi-level properties, which reduces long-term ownership costs significantly.

Schedule building and pest inspections that cost $400-800 but can uncover issues worth thousands in repairs. These professional assessments protect you from expensive surprises after purchase. Original fixtures and fittings often indicate how well previous owners maintained the property overall.

Once you identify suitable properties within your budget and understand their true condition, you can move forward with confidence to make competitive offers and navigate the complex purchase process.

How Do You Secure Your First Home Purchase

Master the Art of Strategic Offer Making

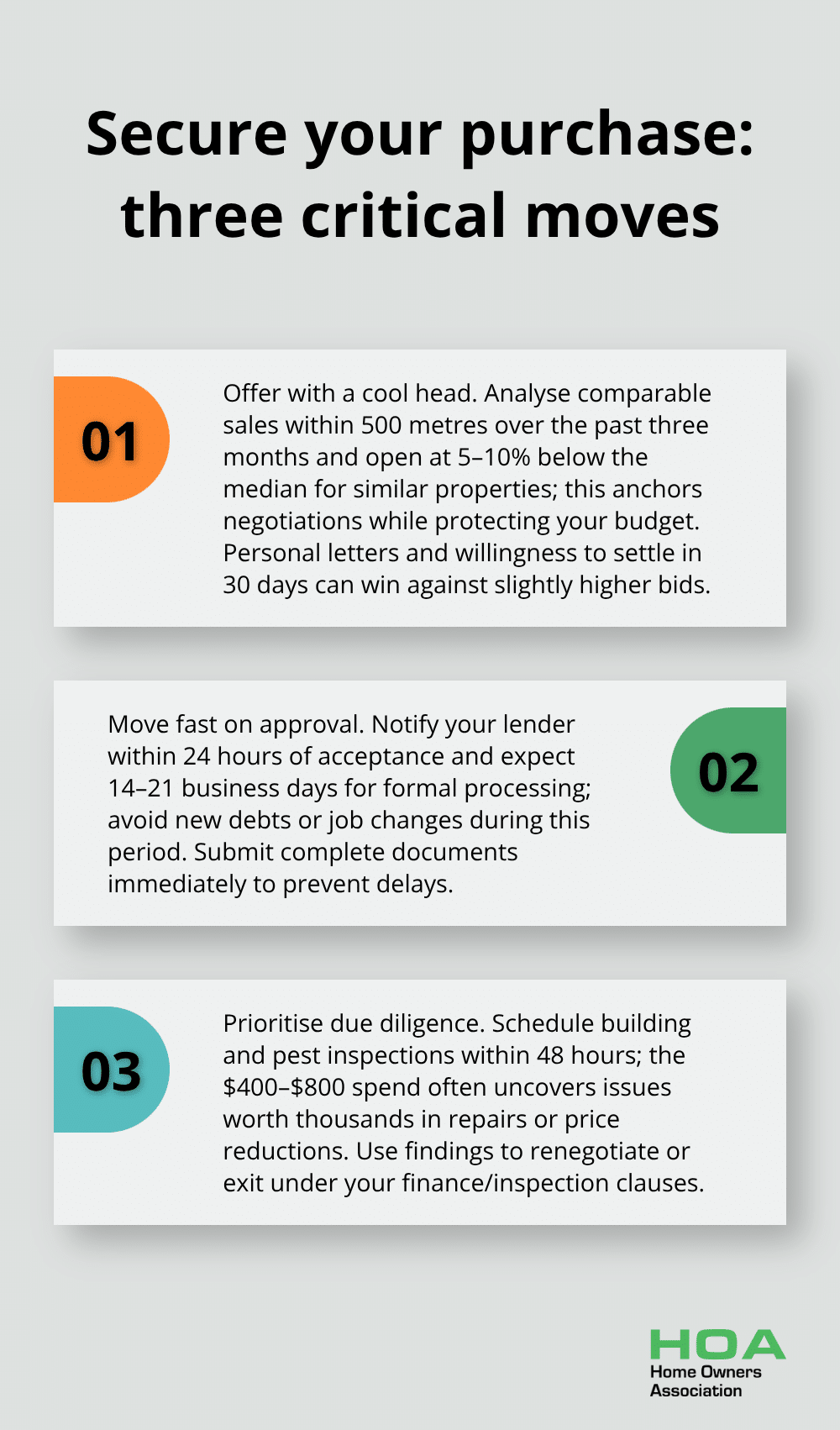

First home buyers who make emotional offers typically overpay by $20,000 to $50,000 above fair market value. Successful buyers analyse comparable sales within 500 metres from the past three months, then offer 5-10% below the median price for similar properties. Cash unconditional offers carry significant weight with sellers, but conditional offers subject to finance and inspection protect your deposit if problems emerge.

Personal letters to sellers can be effective in competitive situations, particularly when multiple offers exist at similar price points. Include your timeline flexibility and genuine connection to the property without revealing your maximum budget. Sellers often accept lower offers from buyers who can settle within 30 days rather than wait 60-90 days for higher offers with uncertain finance approval.

Navigate Mortgage Approval Procedures

Notify your lender within 24 hours of offer acceptance to begin formal loan processing (which typically requires 14-21 business days for completion). Banks verify employment, reassess your financial position, and conduct property valuations that must meet or exceed your purchase price. Your lender will scrutinise any changes to your financial situation during this period, so avoid major purchases or job changes.

Submit all required documentation immediately to prevent delays. Missing paperwork extends approval timelines and risks losing your chosen property to other buyers who move faster through the process.

Complete Essential Property Inspections

Engage a conveyancer immediately after offer acceptance to review the contract of sale and identify potential legal issues before the cooling-off period expires. Professional conveyancers spot problematic clauses that could cost thousands later and protect your interests throughout the transaction.

Schedule building and pest inspections within 48 hours of offer acceptance. These inspections cost $400-800 but frequently uncover problems worth thousands in repairs or price reductions. Professional inspectors identify structural issues, pest damage, and safety hazards that sellers often conceal or overlook.

Handle Settlement and Transfer Procedures

Settlement occurs when property title transfers legally, marking the start of mortgage repayments and your official homeownership responsibilities. Your conveyancer coordinates with the seller’s representative, your lender, and relevant authorities to complete all legal requirements (this process typically takes 30-60 days from contract signing).

Update your budget immediately to accommodate mortgage payments, council rates, insurance premiums, and maintenance costs that average $3,000-5,000 annually for typical Australian homes. Contact utility providers to transfer services and arrange home insurance before settlement day to protect your investment from day one.

Final Thoughts

Successful first home buyers follow methodical financial preparation, strategic property research, and careful navigation of complex purchase procedures. Your journey begins with a solid financial foundation through deposit savings, credit improvement, and pre-approval processes that position you as a serious buyer in competitive markets. Professional guidance proves invaluable throughout this process.

Conveyancers protect your legal interests, building inspectors reveal hidden property issues, and experienced mortgage brokers secure favourable loan terms that save thousands over your loan lifetime. These experts prevent costly mistakes that frequently trap inexperienced buyers. Long-term homeownership success extends beyond purchase completion with ongoing maintenance costs, council rates, and insurance premiums that average $3,000-5,000 annually.

We at Home Owners Association understand the challenges first home buyers face in today’s competitive market. Our expert guidance and resources help members navigate home improvement projects with confidence through trade pricing access and personalised advice. These first home buying tips provide the foundation for your homeownership journey (professional support makes the difference between struggling through challenges and achieving lasting success).