Buying your first home feels overwhelming, but the right preparation makes all the difference. We at Home Owners Association have guided thousands through this process successfully.

These home buying tips for first time buyers will walk you through every step, from checking your finances to closing day. You’ll learn exactly what to expect and how to avoid costly mistakes.

Can You Actually Afford That House?

Your debt-to-income ratio determines everything about your home buying success. Lenders require your total monthly debt payments to stay below 36% of your gross monthly income, with housing costs capped at 28%.

This 28/36 rule isn’t negotiable with most lenders.

Calculate your gross monthly income, then multiply by 0.28 to find your maximum housing payment. A person who earns $80,000 annually can afford $1,867 monthly for housing costs (including principal, interest, taxes, and insurance).

Credit Score Requirements Matter More Than You Think

Your credit score directly impacts your mortgage rate and approval odds. Conventional loans require a minimum 620 credit score, while FHA loans accept scores as low as 580 with a 3.5% down payment. Each 20-point credit score increase can save you $50-100 monthly on mortgage payments.

Check your credit report three months before house hunting to fix errors and pay down high balances. This preparation gives you time to address any issues that could affect your approval.

Down Payment and Emergency Fund Strategy

Save 20% for your down payment to avoid private mortgage insurance, which costs 0.3% to 1.5% of your loan amount annually. First-time buyers can use the Australian Government’s 5% Deposit Scheme to purchase with just 5% down, which eliminates mortgage insurance costs entirely.

Budget an additional 3-5% of the home’s price for closing costs including inspections, legal fees, and stamp duty. Keep six months of mortgage payments in an emergency fund separate from your down payment savings.

Hidden Costs That Catch First-Time Buyers

Property taxes, homeowners insurance, and maintenance costs add significant monthly expenses beyond your mortgage payment. Factor in $200-400 monthly for these ongoing costs when you calculate affordability.

Stamp duty varies by state but can reach $50,000 or more on expensive properties. First home buyers may qualify for exemptions or rebates, so check your eligibility before you finalise your budget.

With your finances sorted, the next step involves finding the right property in the right neighbourhood.

How Do You Find the Right Property?

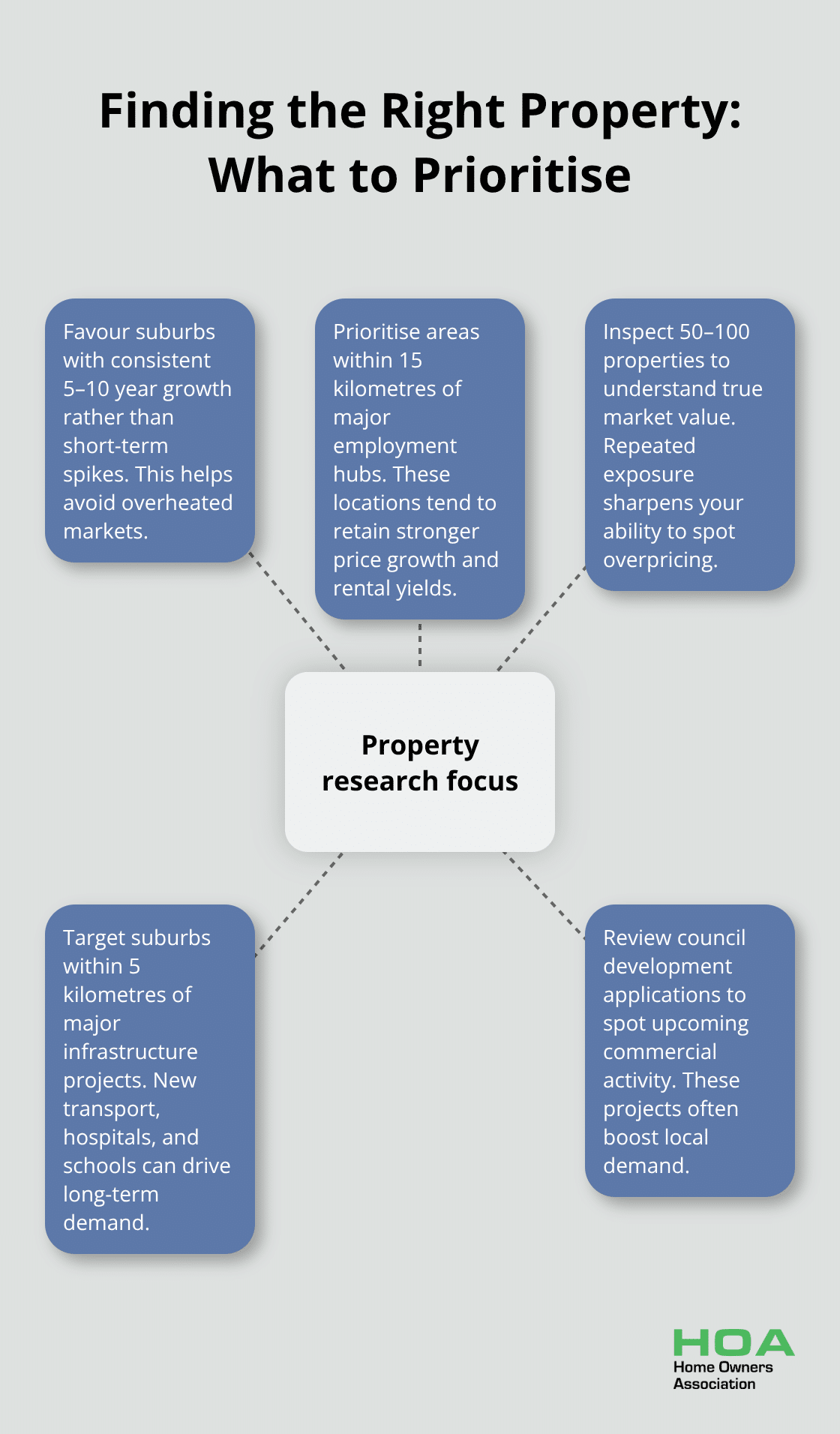

Property research requires strategic analysis beyond online listings. Start with suburbs that show consistent growth over 5-10 years rather than quick price spikes, which often indicate unsustainable markets. Domain and CoreLogic data reveal that suburbs within 15 kilometres of major employment hubs maintain stronger price growth and rental yields. Inspect 50-100 properties to understand true market values, as this exposure helps you recognise genuine opportunities versus overpriced listings.

Target Growth Areas With Infrastructure Investment

Government infrastructure spending creates long-term property value growth. New transport links, hospitals, and schools drive demand for decades after completion.

The Western Sydney Airport development is expected to have significant impact on property values in the area. Research your state’s infrastructure pipeline and target suburbs within 5 kilometres of major projects. Council development applications also reveal upcoming commercial developments that boost local property demand.

Choose Agents Who Know Local Markets

Real estate agents with 5+ years in specific suburbs provide invaluable market insights that online research cannot match. Top agents handle 20-30 transactions annually in their target areas and can predict which properties will attract multiple offers. Mortgage brokers access wholesale rates from 30+ lenders, often securing rates 0.2-0.4% lower than direct bank applications. This rate difference saves $15,000-25,000 over a typical 30-year mortgage (based on current market conditions).

Professional Inspections Save Thousands

Building and pest inspections cost $500-700 but regularly uncover $10,000-50,000 worth of hidden problems. Structural engineers identify foundation issues, roof damage, and electrical hazards that property stylists cleverly conceal. Termite infestations can cause substantial property damage, which makes pest inspections essential. Schedule inspections during your cooling-off period to maintain negotiation power if major issues surface.

Once you identify the right property and complete your inspections, you need to secure financing and navigate the complex purchase process (which involves multiple critical steps and deadlines).

How Do You Navigate the Purchase Process

Mortgage pre-approval transforms you from browser to serious buyer with actual power to purchase. CommBank’s conditional pre-approval takes 10 minutes online and remains valid for 90 days, which provides sufficient time to find the right property. Pre-approved buyers win 73% more offers according to Real Estate Institute data because sellers prioritise guaranteed transactions over uncertain finance.

Submit income statements, bank statements, and employment verification to secure your pre-approval before any property inspections.

Strategic Offer Tactics That Win Properties

Competitive markets demand strategic thought beyond price alone. Cash offers win 87% of bidding wars even when 5-10% below the highest bid because sellers value certainty over maximum price. Structure your offer with a 10% deposit and 42-day settlement to demonstrate financial strength while you allow sufficient time for inspections and final approvals.

Include building and pest inspection clauses in every offer to protect against costly surprises after purchase. Successful buyers research comparable sales within 500 metres of their target property and offer 2-5% above recent transactions to secure acceptance without significant overpayment.

Document Submission and Approval Timeline

After you sign the Contract of Sale, submit all documentation to your lender for final checks (including property valuation and credit assessments). Formal loan approval typically occurs within 1-5 business days after you submit necessary documents post-contract signature. Your lender will co-ordinate with your solicitor to verify all conditions are met before settlement day arrives.

Final Inspections Protect Your Investment

Pre-settlement inspections allow buyers to check their property is in the same condition as when they bought it and verify that sellers have maintained the property as agreed. Check that all included fixtures remain in place, agreed repairs are completed, and no new damage has occurred since your initial inspection.

Settlement typically happens 4-6 weeks after contract signature, and your solicitor will co-ordinate the final fund transfers and title registration. Keep settlement funds in your transaction account at least 48 hours before the scheduled date to prevent delays that could cost thousands in penalty fees (your solicitor will advise the exact amount required).

Final Thoughts

First-time home purchase success requires methodical preparation and professional support. You must calculate your debt-to-income ratio, secure pre-approval, and research growth suburbs with infrastructure investment. Professional inspections and strategic offers win properties while they protect your investment from costly surprises.

These home buying tips for first time buyers work when you follow each step systematically. Experienced agents, mortgage brokers, and solicitors prevent expensive mistakes that derail purchases. Their expertise navigates complex contracts, inspections, and settlement processes that overwhelm inexperienced buyers.

Homeownership builds substantial long-term wealth through property appreciation and mortgage principal reduction. Australian property values have grown 7.2% annually over the past 20 years (creating significant equity for patient owners). We at Home Owners Association support Melbourne homeowners with trade access, expert advice, and educational resources.