Buying your first home feels overwhelming, but the right preparation makes all the difference. We at Home Owners Association have guided thousands through this process successfully.

These essential tips for first time home buyers will help you avoid costly mistakes and secure the best possible deal. Smart planning today leads to homeownership tomorrow.

How Much House Can You Actually Afford?

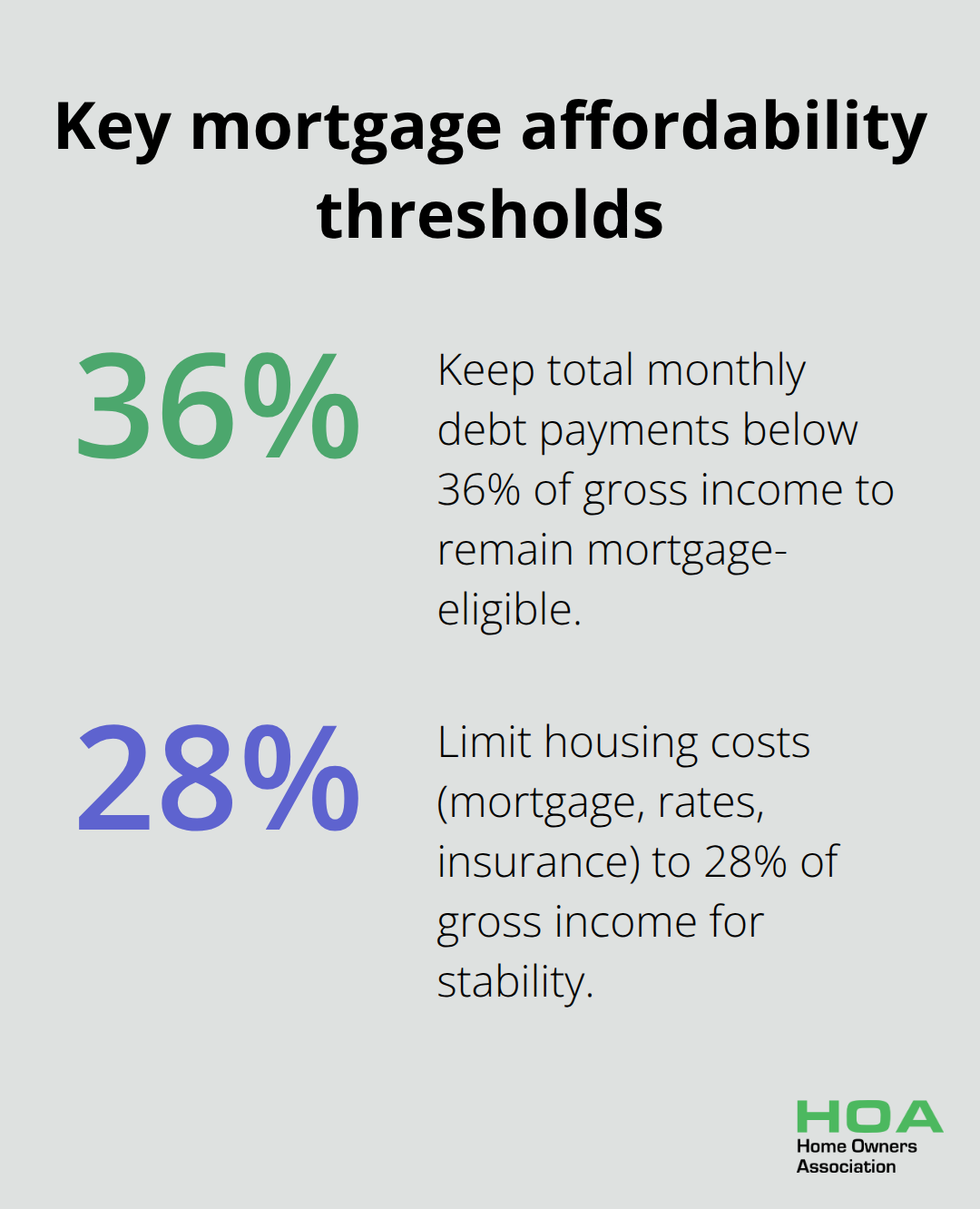

Your debt-to-income ratio determines your buying power more than any other factor. Lenders require your total monthly debt payments to stay below 36% of your gross monthly income, with housing costs capped at 28%. Someone who earns $80,000 annually qualifies for maximum housing payments of $1,867 monthly. These ratios exist because mortgage defaults spike dramatically when borrowers exceed these thresholds.

Your credit score directly impacts your borrowing costs too. Conventional loans demand minimum scores of 620, while FHA loans accept 580 with larger down payments. Each 20-point credit score increase saves $50 to $100 monthly on mortgage payments over the loan term.

Calculate Your True Buying Budget

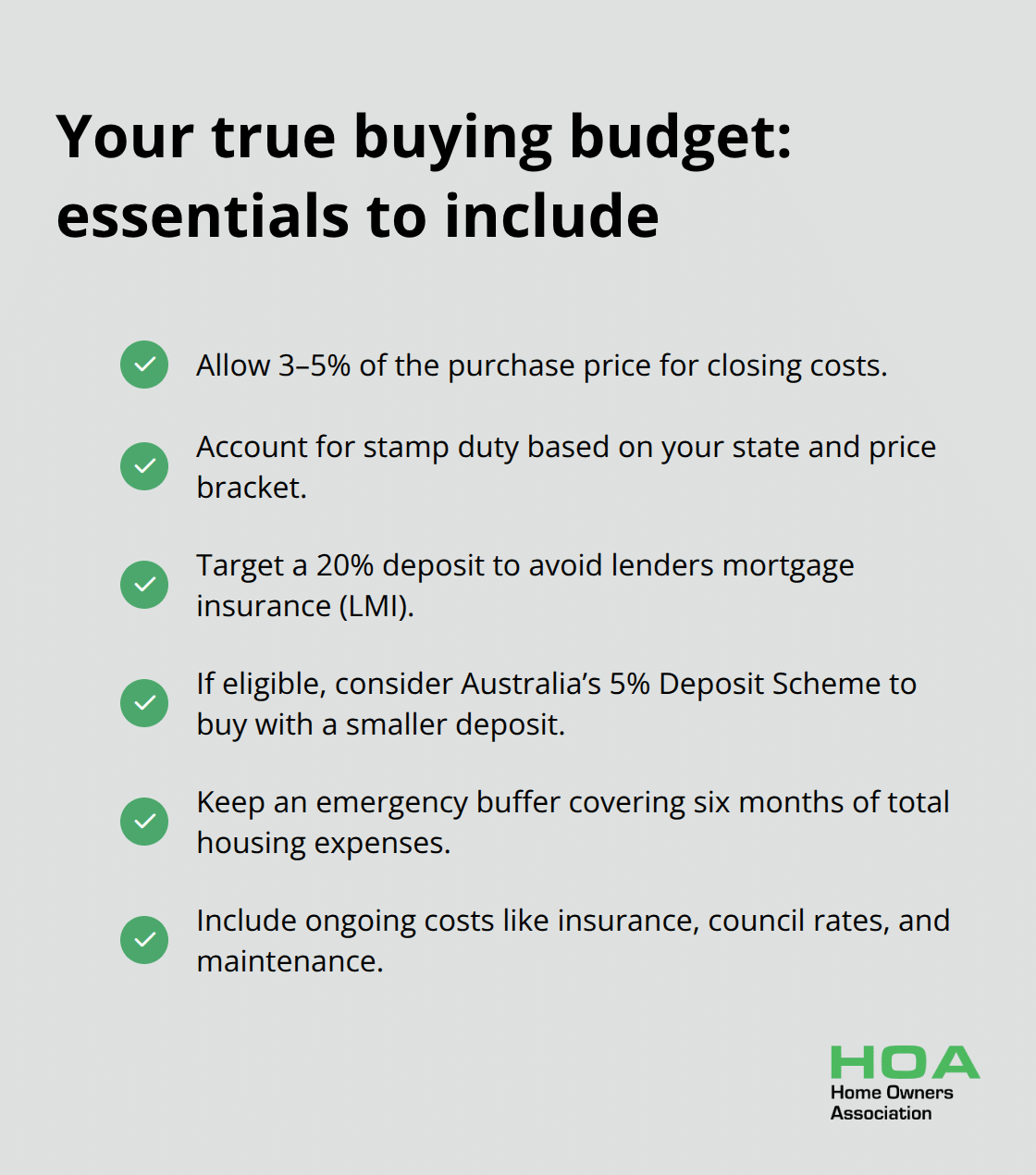

Most buyers underestimate total homeownership costs when they focus only on mortgage payments. Property taxes, insurance, and maintenance costs typically consume an extra $200-400 monthly beyond your mortgage. You should budget 3-5% of the home’s purchase price for closing costs (including inspections, legal fees, and stamp duty).

Stamp duty varies dramatically by state and can reach $50,000 on expensive properties, though first-time buyer exemptions often apply. Try to save 20% for your down payment to avoid private mortgage insurance, but government programs like Australia’s 5% Deposit Scheme let qualified buyers purchase with just 5% down. Always maintain emergency funds that cover six months of total housing expenses after your purchase.

Secure Pre-Approval Before You Shop

Mortgage pre-approval shows sellers you’re serious and can close quickly. Pre-approved buyers have significant advantages over unqualified shoppers because sellers prioritise certainty over higher bids. The pre-approval process takes as little as 10 minutes online and stays valid for 90 days.

Mortgage brokers often secure better rates than direct bank applications (potentially saving $15,000 to $25,000 over a 30-year loan term). Submit income verification and employment documents promptly to expedite approval. Pre-approval also reveals your actual borrowing capacity, which prevents wasted time when you view properties outside your budget range.

Once you understand your financial limits and secure pre-approval, you can focus on the next critical step: finding the right property in the perfect location.

Where Should You Actually Buy?

Property location, along with factors like property type and market conditions, plays a crucial role in determining your investment return. Target suburbs within 15 kilometres of major employment hubs, which Domain and CoreLogic data shows deliver stronger price growth and rental yields. Government infrastructure projects historically drive long-term property values, so investigate planned roads, rail lines, and schools before you purchase.

Crime statistics from local police departments and school ratings from government education websites reveal neighbourhood quality better than any real estate marketing material.

Research Like a Data Scientist

Inspect 50-100 properties to understand true market values and recognise genuine deals versus overpriced listings. Real estate agents with 5+ years in specific suburbs provide invaluable insights that online research misses completely.

CoreLogic reports show suburbs with consistent 5-10 year growth outperform those with quick spikes by 40% in long-term returns. Professional inspections before purchase prevent costly surprises that destroy your budget after settlement.

Uncover Hidden Property Issues

Professional inspections cost only $500-700 upfront but uncover hidden issues worth $10,000-$50,000 in repairs. Building and pest inspections reveal structural problems, electrical faults, and termite damage that sellers often hide from buyers.

These inspections protect your investment and provide negotiation leverage when you discover problems. Most sellers will reduce their asking price when inspections reveal significant defects.

Win Through Strategic Analysis

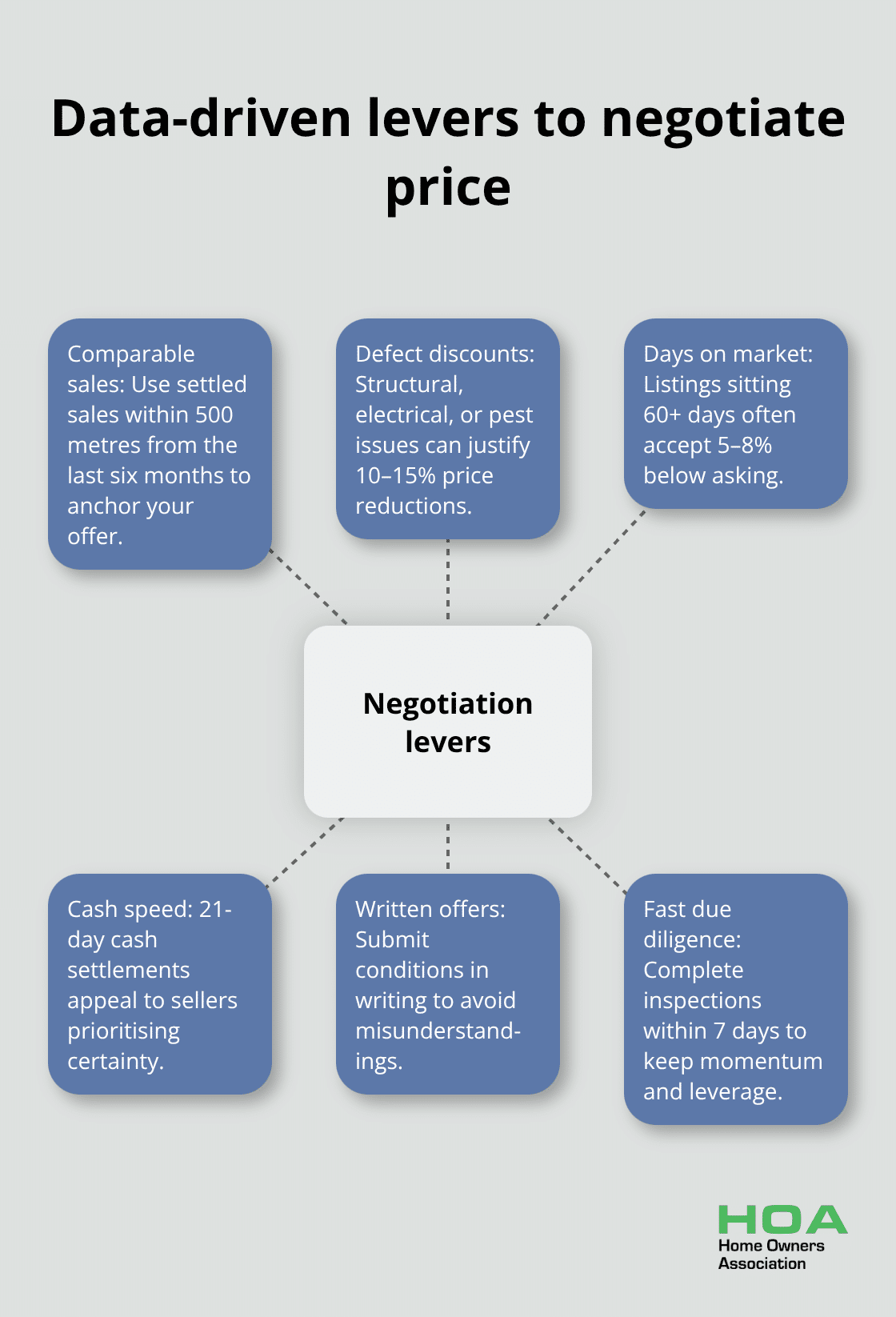

Cash offers provide advantages in competitive situations because sellers prioritise certainty above maximum price. Recent sales data from the past six months within 500 metres gives you accurate pricing benchmarks for negotiations.

Property valuations can vary 15-20% between assessors (so obtain multiple opinions before you make offers). Final inspections before settlement protect against last-minute property damage or undisclosed changes.

Once you identify the perfect property in your target location, you need to navigate the complex purchase process that transforms your research into actual homeownership. For comprehensive guidance on every step of this journey, check out our detailed tips for buying your first home.

How Do You Close the Deal Successfully?

Professional representation transforms complex negotiations into smooth transactions that protect your interests. Real estate agents with proven track records in your target suburbs possess market knowledge that saves thousands through strategic advice on price and timing. These experienced professionals understand which sellers accept lower offers and which properties stay overpriced for months.

Conveyancers with specialised property law expertise prevent contract disasters that destroy deals after weeks of negotiations. Choose conveyancers who handle 200+ transactions annually because volume creates efficiency and reduces costly delays. Settlement periods typically span 30-45 days, but experienced conveyancers complete documentation faster and identify potential problems before they become expensive roadblocks.

Master Contract Terms Before You Sign

Contract conditions protect buyers from financial disasters when properties fail inspections or finance falls through. Building and pest inspection clauses provide legal rights for renegotiating or withdrawing offers, though withdrawal is rarely allowed and may require legal action. Finance approval conditions protect your deposit if lenders reject your application after contract execution.

Cooling-off periods vary by state but typically provide 3-5 business days to withdraw without penalty in private sales. Auction purchases eliminate cooling-off rights completely, so attend multiple auctions before you bid seriously. Deposit amounts usually range from 5-10% of purchase price and become non-refundable after cooling-off periods expire.

Settlement dates should align with your mortgage approval timeline because delays cost hundreds in extension fees and legal charges.

Negotiate With Market Data

Recent comparable sales within 500 metres provide concrete evidence for price negotiations rather than emotional appeals. Properties with structural issues, outdated electrical systems, or pest damage justify 10-15% price reductions from initial prices.

Sellers who list properties for 60+ days often accept offers 5-8% below the price because costs accumulate quickly. Cash settlements within 21 days appeal to motivated sellers who prioritise speed over maximum price (though most buyers need mortgage finance).

Submit written offers with specific conditions rather than verbal negotiations that create misunderstandings later. Professional inspections completed within 7 days maintain momentum while they protect your investment from hidden defects that surface after purchase.

Final Thoughts

Successful first-time home purchase demands systematic preparation across three essential areas: financial readiness, property research, and professional guidance. Your debt-to-income ratio below 36% and credit score above 620 create the foundation for mortgage approval. Understanding true affordability through the 28% housing cost rule prevents overextension that leads to financial stress.

Property research through comparable sales data and professional inspections protects your investment from costly surprises. Target suburbs within 15 kilometres of employment hubs and government infrastructure projects to maximise long-term value growth. These tips for first time home buyers transform overwhelming decisions into manageable steps that lead to successful ownership.

Professional representation through experienced real estate agents and conveyancers prevents contract disasters and negotiation mistakes. Australian property values have grown 7.2% annually over the past 20 years (making homeownership a proven wealth-building strategy when approached correctly). We at Home Owners Association provide expert advice and educational resources that help members make informed property decisions.